Winter travel look ahead: travelers will largely stay stateside, while inflation remains the real "Grinch"

54% of winter travelers will be making a trip for the holidays

Winter travelers will largely stay stateside, with 75% of travelers taking domestic trips, led by Baby boomers at 87%. Younger consumers lead in international travel, with 52% each of Gen Z and millennials spending at least a portion of their trip outside of the U.S. Winter travelers plan to treat themselves to restaurant meals (60%), shopping trips (53%), and visits to attractions (36%).

Inflation is the real travel Grinch

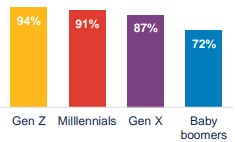

This year, 86% of winter travelers said that inflation is impacting their travel plans. Travelers are coping by spending less to prepare for their trip (27%), using credit cards to better manage the costs (22%), and working overtime to generate more income (21%).

Plans impacted by inflation

Nine in 10 plan to go shopping for their trip

Ninety percent of winter travelers will shop to prepare for their trip. Their top purchases include apparel (59%), footwear (40%), and beauty/personal care products (39%).

Shopping to prepare for their trip

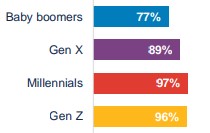

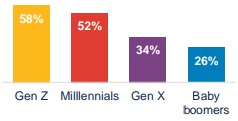

Travel is on many gift wish lists

Nearly three-quarters (74%) of winter travelers would like to receive a gift of travel, led by millennials at 82%. When it comes to giving travel as a gift, younger generations lead: 58% of Gen Z and 52% of millennials have gifted travel, compared to the average of 43%.

Have given a gift of travel in the past

Key takeaway: Brands have opportunities beyond the holiday moment

Whether traveling to celebrate the holidays with family and friends or taking a much-needed vacation, winter travelers have a lot to look forward to. Brands can help their customers navigate inflation’s challenges by focusing on value and offering a compelling assortment of products that speak to travelers’ needs and wish lists.

Source: Bread Financial proprietary study, Winter Travel Look Ahead, October 2024.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.