Back to school 2024: Shoppers aiming for an A+ in deal hunting

Eight out of 10 plan to seek sales and shop around, rising from 2023.

With 89% of back-to-school/college (BTS/BTC) shoppers saying that inflation is impacting their planned spending, scouting retailers for the best sales and deals is shoppers’ top strategy for keeping budgets in check this year. Adding to the pressure of finding the best prices? A rising number of back-to-class shoppers are planning to spend the same this year, with fewer intending to spend more.

Watching spend

The majority (56%) plans to spend the same on BTS/BTC purchases this year, rising from 2023 (38%) and siphoning from those spending more. Those spending more are being driven to do so by need, specifically inflation (55%) and/or advancing students becoming more expensive (46%).

Focusing on sales

Overall, 79% of BTS/BTC shoppers are planning to seek deals and shop around this year, up significantly from the 70% who did so last year. This figure is being elevated by substantial increases in watching for discounts and shopping sale events like Amazon Prime Day.

Considering credit

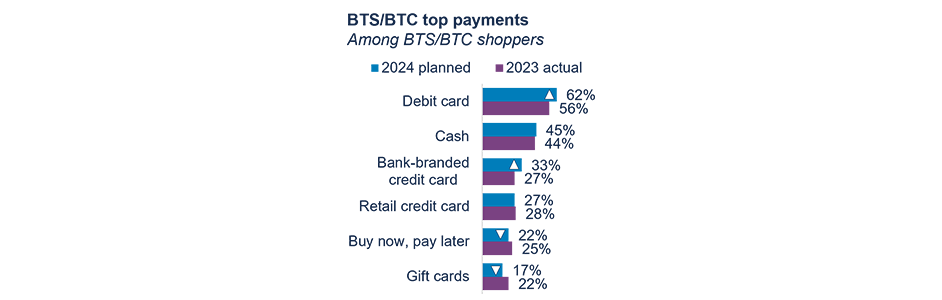

While budget-focused shoppers are relying on debit cards and cash this year, bank-branded and retail credit cards are solid alternative options, up from and on par with 2023 usage trends, respectively.

Key takeaway: Appealing to the needs of back-to-class shoppers

While back-to-school/college shopping is typically driven by the needs of checking off school supply lists or outfitting growing children, this year’s class of shoppers is also being driven by a need to save. Retailers seeking to ring up sales during this all-important lead-up to the holiday season should promote competitive discounts and deals to attract the masses but save the biggest bargains for their best customers.

Source: Bread Financial Back-to-school/college Look Ahead survey, Jul-24

Arrows indicate significant differences vs. Bread Financial Back-to-school/college Hindsight survey, Sept-23

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.