Holiday 2024: Shoppers will be celebrating sales this season

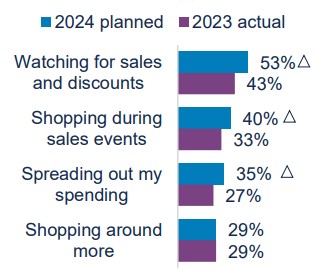

Three-quarters of shoppers (76%) will be seeking deals, shopping events and shopping around for holiday purchases, up from 69% last year.

With 89% indicating that inflation is impacting holiday purchase plans, most shoppers are aiming to spend the ‘same’ for holiday this year compared to last – and they will be on the lookout for sales and promotions to achieve that. Though it will be a sale-driven, competitive market, with an increasing number of shoppers planning to shop in-stores (+10% over 2023), brands potentially have better opportunities to capture shopper attention this year.

How they are spending

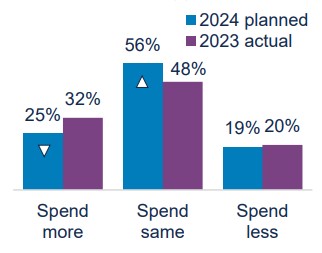

This year, a quarter of shoppers (25%) are planning to spend ‘more’ on holiday purchases this year compared to last, down seven points from 2023 (32%). Instead, shoppers are signaling that they are trying to rein in spending: 56% of shoppers plan to spend the ‘same,’ rising significantly from 2023 (48%).

Holiday spending plans among holiday shoppers

How they are saving

Half (51%) plan to begin their holiday shopping by late October, rising from the 38% who began by this time last year. Sale-seeking shoppers might be anticipating early-season discounts (like Prime Day), but also look for shoppers to home in on Black Friday discounts as election distractions dissipate

Holiday shopping strategies among holiday shoppers

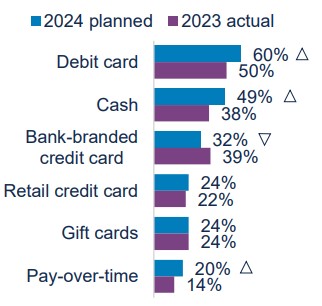

How they are paying

Not surprisingly, budget-minded shoppers plan to lean into debit card usage as their top holiday payment. However, retail credit cards are holding steady while pay-over-time financing rose over 2023.

Holiday top payments among holiday shoppers

Key takeaway: Capturing shopper attention in a sale-driven, competitive environment

Expect sales and promotions to rule the season as shoppers attempt to keep their holiday spending in check this year. While shoppers’ attentions may flit from retailer to retailer as they scope the best deals, they are particularly more likely to be doing so across physical stores compared to 2023. Savvy brands should capitalize on this as an opportunity to engage shoppers 1:1 about retail card programs – and associated rewards/discounts – to emphasize the value in transacting with this form of tender.

Source: Bread Financial proprietary study, Holiday Look Ahead survey, September 2024. Arrows indicate significant differences vs. Bread Financial Holiday Hindsight survey, January 2024

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.