Holiday 2023: Nearly half (45%) plan to travel this year

Holiday-related travel plans are down from 53% in holiday 2022*

Holiday travel generally evokes thoughts of piling into the station wagon, running through a crowded airport or even trekking to snow-covered Vermont, but fewer consumers may live these experiences this year. With inflation the ‘gift’ that keeps on giving, it appears that some holiday celebrants may be pulling back on travel plans to keep budgets in check. In total, 45% plan to travel for the 2023 holiday season (to visit family/friends and/or take a vacation), down from the 53% who intended to do so last year. Read on for a closer look at this year’s plans.

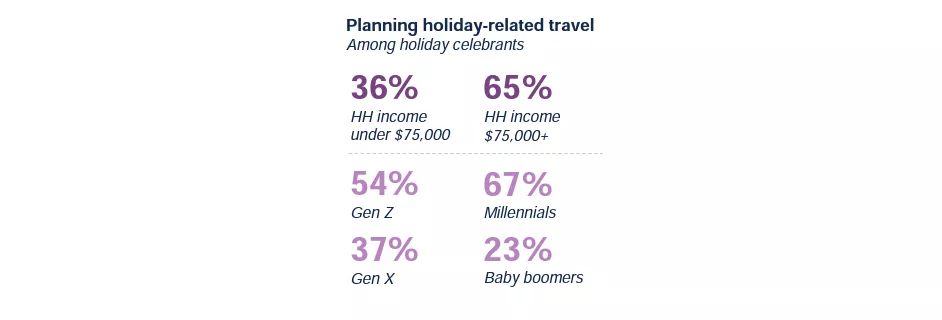

Who plans to travel?

Perhaps expectedly in this uncertain macro environment, higher-earning households maintain the most bullish outlooks on holiday travel this year. And generationally, millennials and Gen Z outpace their older cohorts.

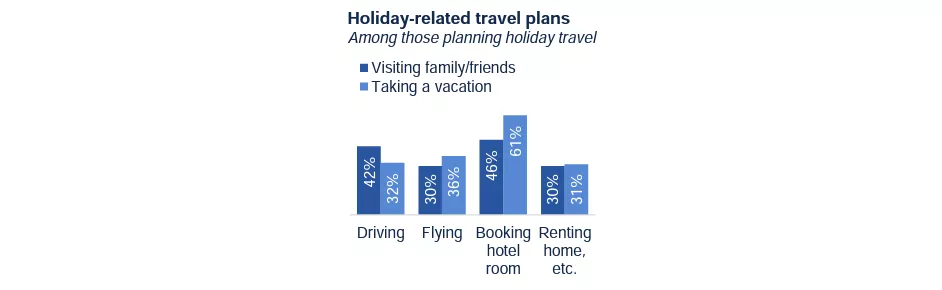

What will they do?

Overall, 30% of holiday celebrants are planning to visit family/friends, while 23% are booking vacations (equating to 45% with travel plans, net). Naturally, it does appear that the mission of the trip is driving travel-related plans.

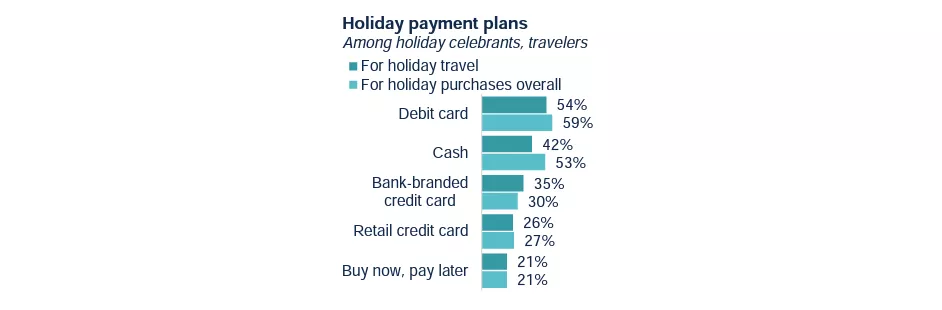

How will they pay?

As with holiday preferences plans at large, travelers are attempting to stick to debit cards and cash to fund their travel spending. However, credit cards, along with buy now, pay later, are solid alternatives.

Key takeaway: Making experiences count

Tempered holiday travel plans seem to be another proof point that broader holiday spending will be more cautious and intentional this year. No matter your industry, it’ll be important to consider the budgetary constraints of inflation-weary consumers. Providing a positive experience in the near term could encourage return visits over the longer term – particularly when consumers feel they are on firmer financial footing.

Source: Bread Financial proprietary study, Holiday Look Ahead survey, September 2023.

*Source: Bread Financial proprietary study, Holiday Look Ahead survey, September 2022.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.