Valentine’s Day 2025: Shoppers are in the mood to celebrate

Nearly two in five (38%) plan to spend ‘more’ this year, up from 31% in 2024. With Valentine’s Day 2025 optimally landing on Friday this year, shoppers are seeing red – in a good way. Compared to last year, more celebrants are planning to give flowers, cards or gifts (72% vs. 68% in 2024), dine out at restaurants (53% vs. 47%), cook special meals at home (40% vs. 37%) and even take trips/vacations (14% vs. 11%). And it appears that spending will follow suit: 38% of celebrants plan to spend ‘more’ this year, rising more than 20% over 2024 (31%). Read below for more details on how shoppers plan to show the love this year.

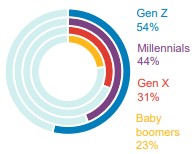

Gen Z, millennials are bringing the heat

While spending overall is more optimistic this year, younger cohorts appear to be driving this trend. Gen Z and millennials maintain more bullish outlooks compared to Gen X and baby boomers.

Planning to spend ‘more’ for Valentine’s Day among Valentine’s Day celebrants

Shopping around

Following recent winter holiday trends, Valentine’s shoppers plan to engage with a wider variety of retailers this year. While superstores remain the top destination (37%), category specialists may feel more love from shoppers this year.

Select Valentine's retail destinations among Valentine's celebrants

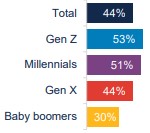

Enticed by credit card incentives

Supporting positive spending sentiment, 44% of Valentine’s shoppers say that credit card offers (e.g., special discount, 0% financing or pay-over-time convenience) could entice them to spend more than expected, up from 38% in 2024.

Credit card offers (net) could entice additional Valentine’s spend among Valentine's celebrants

Key takeaway: Earning shoppers’ affection

While Valentine’s Day spending sentiment has improved year-over-year, inflation concerns continue to linger among most celebrants (79% vs. 77% in 2024), so spending on the holiday – and for the foreseeable future – isn’t expected to be a free-for-all. Retailers and brands will need to communicate strong value propositions to earn shoppers’ affection: unique, differentiated products or services coupled with attractive price points or promotions.

Source: Bread Financial Valentine’s Day Look Ahead survey, January 2025

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.

Related News

Financial Innovation

Winter travel look ahead: travelers will largely stay stateside, while…

November 18, 2024

Financial Innovation

Holiday 2024: Shoppers will be celebrating sales this season

October 1, 2024

Financial Innovation

Back to school 2024: Shoppers aiming for an A+ in deal hunting

July 31, 2024