Valentine’s Day 2024: Gen Z is in love with … love

Nearly half of Gen Z Valentine’s Day shoppers plan to spend ‘more’ this year.

Fresh off a more muted season for holiday spending, shoppers seem to be less likely to feel the love this Valentine’s Day. Among those celebrating, just 31% plan to spend ‘more’ on Valentine’s purchases this year compared to last, down from 39% in 2023. The generational exception is Gen Z. Almost half (47%) of those born between 1997 and 2006 plan to increase their spending this year, perhaps driven by their love for, well, love. Read on to find out why retail’s cupids should aim their arrows at this group of spenders.

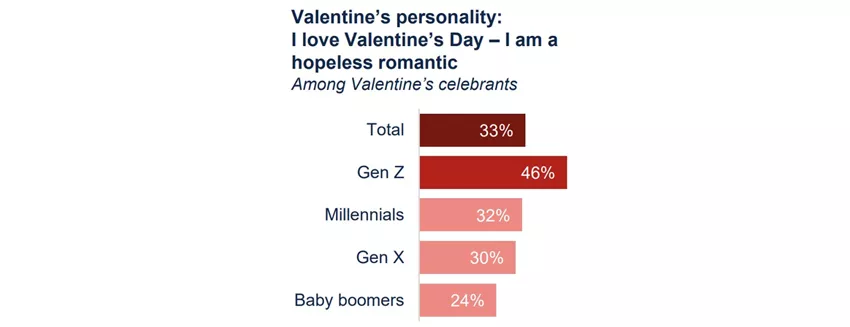

Feeling the love

When asked about their feelings about Valentine’s Day on a spectrum of options, Gen Z celebrants were most likely to say they were hopeless romantics, perhaps driving their engagement with the holiday compared to generational peers.

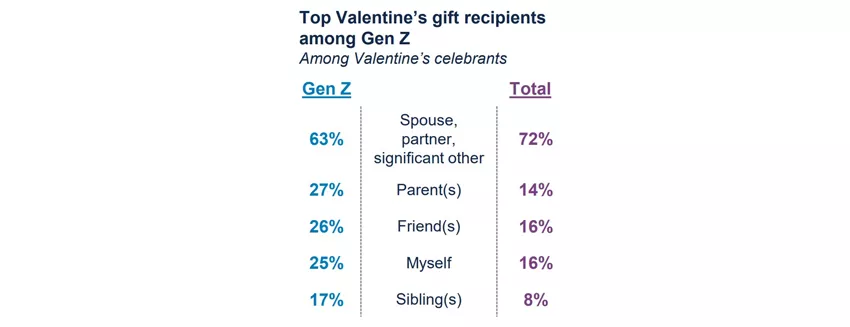

Showering others with gifts

While most, including Gen Z, plan purchase Valentine’s gifts for their spouses or partners, the youngest cohort is also more likely to show affection for a wider variety of recipients than average, including themselves.

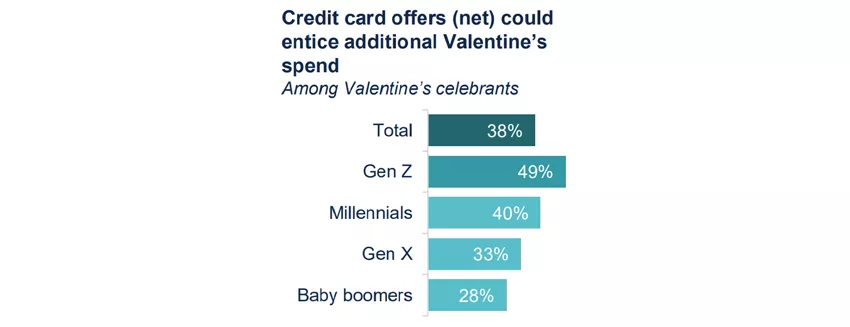

Attracted to credit card incentives

Gen Z shoppers are also most likely to be swayed into spending more than intended if the right credit card option (e.g., special cardholder discount, 0% financing or convenience of paying over time) is available to them.

Key takeaway: Finding the opportunities

While overarching Valentine’s Day insights seem to support the economic ‘soft landing’ projected in the first half of 2024, bright spots in consumer spending can still be found. Homing in on primed-to-spend audiences (in this case, Gen Z) with relevant + personalized messaging, compelling offers and payment options that suit their needs could be key to leveraging these types of opportunities while standing apart from the competition.

Source: Bread Financial proprietary study, Valentine’s Day Look Ahead survey, January 2024

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.