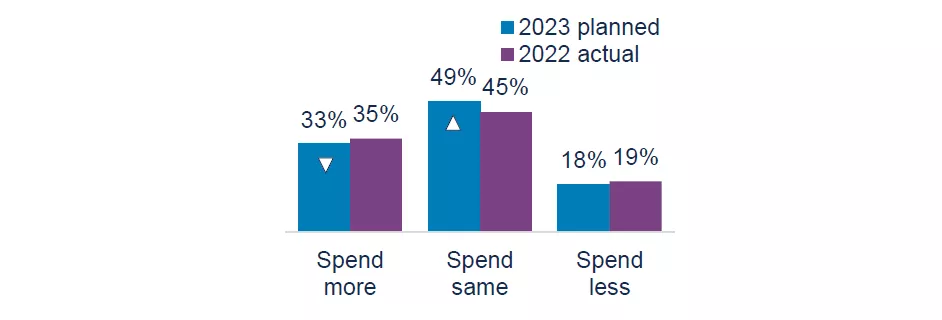

Three out of four holiday shoppers (76%) plan to seek deals, shop savings events and shop around this year, higher than holiday 2022 (69%).

Unfortunately for shoppers – and retailers – inflation continues to be the ‘gift’ that keeps on giving. This holiday season, 89% of shoppers indicate that price hikes are impacting their planned purchases, up from 86% last holiday. All signs point to spending that is very intentional, stretched over time – and driven by deals.

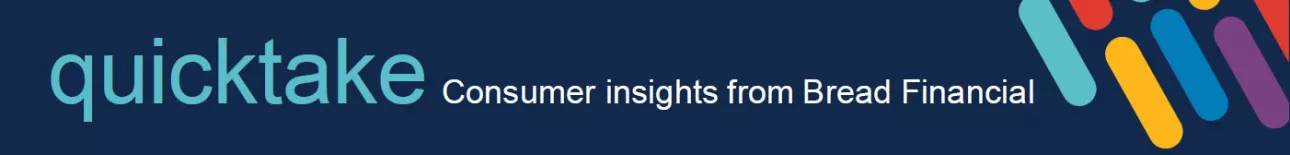

Tempering spending plans

One-third (33%) plans to spend ‘more’ on holiday purchases this year, down two points from 2022. Among those planning to spend more, 58% are doing so because they want to (up from 49% in 2022), though 42% are doing so because they need to due to inflation (versus 51% in 2022).

Holiday spending plans

Among holiday shoppers

Priming to save money and stretch budgets

Half (50%) expect to begin their holiday shopping by late October, up from 42% last year. This was perhaps precipitated by autumn sales events, like Prime Day, but also by shoppers’ desire to stretch their spending over a longer time period to keep budgets balanced.

Holiday shopping strategies

Among holiday shoppers

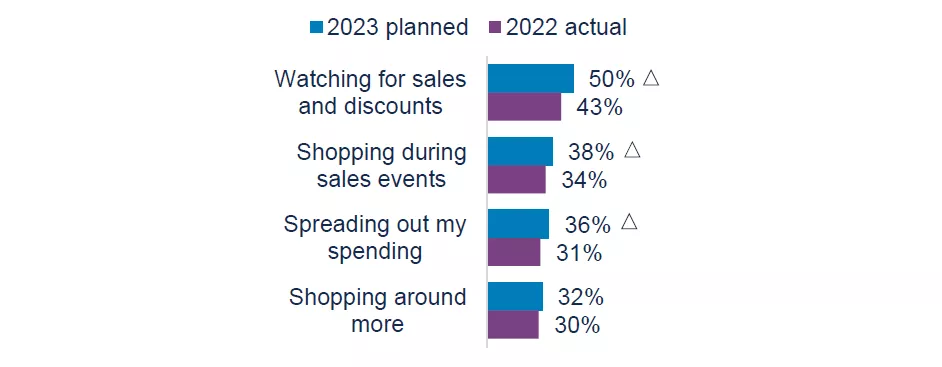

Hedging toward debit, cash payments

Likely to assist in budgeting, holiday shoppers plan to lean into cash and debit cards. However, intent to use retail cards is holding steady from last year, while buy now, pay later plans are up from 2022.

Holiday top payments

Among holiday shoppers

Key takeaway: Striking the right chord with holiday shoppers

While the holiday spending outlook isn’t bleak, shoppers will be keeping their spending in check. Key to winning this season will be marketing to customers via relevant channels, rich and timely promotions and, last but not least, compelling, front-and-center value propositions – ensuring that customers feel confident in their purchases and parting with their hard-earned dollars.

Source: Bread Financial proprietary study, Holiday Look Ahead survey, Sept-23.

Arrows indicate significant differences vs. Bread Financial Holiday Hindsight survey, Jan-23.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.