Mother’s Day 2025: Not overly bullish, but not pulling back

Shopping and spending plans are remarkably similar to last year.

Tariff turmoil is rocking sentiment and placing the U.S. economy on unsteady ground, but consumers are making sure that moms feel celebrated. This year, most shoppers (61%) plan to spend the ‘same’ for Mother’s Day, a third plan to spend ‘more’ (33%), while few (6%) plan to pull back and spend ‘less.’ These figures are nearly identical to 2024, indicating that while shoppers aren’t likely to overspend on the holiday this year, they will still be making sure that the moms in their lives feel appreciated.

Spending more

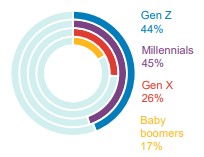

While Mother’s Day spending plans overall are in a holding pattern compared to 2024, Gen Z and millennials are maintaining more bullish outlooks than their older counterparts, with their plans to spend ‘more’ surpassing the overall average.

Planning to spend ‘more’ for Mother’s Day Among Mother’s Day celebrants

Shopping outside the box

While superstores (31%) and florists/garden centers (30%) are perennial favorites among Mother’s Day shoppers at-large, younger shoppers, especially Gen Z, plan to shop a wider array of destinations to secure the perfect gifts.

Gen Z: Top Mother’s Day retail destinations Compared to Total celebrants

Considering credit

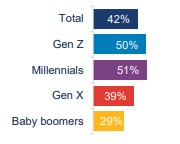

While major overspending isn’t on the horizon, half of younger cohorts could be enticed to spend more than intended if the right credit card option (e.g., special cardholder discount, 0% financing or convenience of paying over time) is available to them.

Credit card offers (net) could entice additional Mother’s Day spend Among Mother’s Day celebrants

Key takeaway: Coaxing spending in an uncertain economy

While Mother’s Day is likely to weather current economic uncertainty – thanks in large part to the sentiment surrounding the holiday – spending in other more everyday areas might be more at risk in the near term. With consumers likely to begin watching what and how they spend with more scrutiny, it’ll be imperative for retailers to deliver compelling products at attractive prices, ensuring that the overall experience leaves shoppers feeling good about what they do end up spending.

Source: Bread Financial proprietary study, Mother’s Day Look Ahead survey, April 2025.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.