Quicktake: Inflation has a greater impact on women

Inflation has a greater impact on women

Women are more likely to feel impact of inflation and to pull back on spending

While seven in 10 Americans say inflation is having a financial impact on them, women are more likely than men to feel the pain of higher prices: 81% of women said inflation is having an impact on them vs. 72% of men. And women are 3x as likely to be taking steps to curb spending compared to 6% of men who say they’re doing nothing at all.

Gas and groceries are squeezing her budget

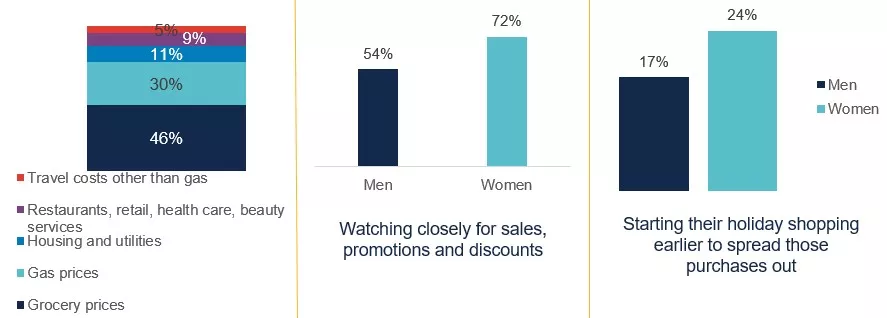

Higher food (46%) and fuel (30%) prices are the top inflation culprits for women. Housing is also getting more expensive: 6% said rent/housing costs and 5% said utilities are impacting them the most.

Women are more likely to be deal-seeking

Nearly 75% of women are watching closely for sales, promotions and discounts, compared to only 54% of men doing the same.

She’s spreading out her spending

Women are more likely to start holiday shopping earlier (24% vs. 17%), postpone a major purchase (41% vs. 32%) and shop for fun less often (52% vs. 33%) than men.

Key takeaway: Brands should be strategic in their holiday promotional offerings

This year women will be shopping earlier and on the hunt for the best deals to stretch their budgets. Retailers should prepare for an extended holiday shopping season, including targeted discounts/offers and gifts with purchase that can be dropped over time.

Source: Bread Financial proprietary study, Inflation Pulse Check, September 2022.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.