Looking into 2025: Shopper predictions for the new year

It’s a new year, but we can expect familiar shopping behaviors from consumers. With a solid Holiday 2024 shopping season in the books, it’s time to look into the crystal ball for 2025. With overarching uncertainty likely to persist – given continued frustrations with elevated prices as well as a new political administration – expect consumers to rely on familiar behaviors when spending in the new year. Read on for three of our predictions, based on recent consumer research insights from Bread Financial’s annual Holiday Hindsight survey.

Motivated by sales

With 87% of holiday shoppers indicating that inflation impacted their holiday purchasing in 2024 (up from 84% in holiday 2023), expect smart-shopping strategies, like watching for price discounts and shopping major sales events, to prevail in 2025.

Smart-shopping actions taken by holiday shoppers

Engaging with a variety of retailers

While superstores continued as the top holiday destination, shoppers browsed a wider variety of retailers this year, including off-price and category specialists. This trend could continue for 2025 as shoppers seek deals and differentiated products that entice them to spend.

Where the holiday shoppers purchased, select retailer types shown

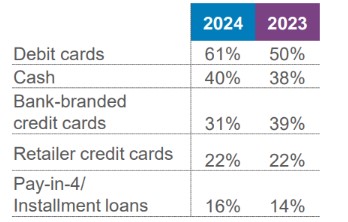

Relying on debit cards

Cost-conscious shoppers relied on debit cards for holiday purchases, seemingly at the expense of bank-branded credit cards. However, use of retailer credit cards and pay-over-time were consistent as shoppers leveraged exclusive rewards and favorable financing terms. Similar payment appetite could persist in the new year.

Holiday shopper payment types1, select payment types shown

Key takeaway: Closing the sale in 2025

While value-driven shoppers continue to watch how they spend given uncertainties, they still exhibit a willingness to spend – thanks at least in part to stability of the employment environment.2 The new year is likely to present its own challenges to retailers, but those who deliver clear and compelling value propositions, driven by differentiated offerings and governed by customer-centric mindsets, will likely win over shoppers this year – and beyond.

Source: Bread Financial Holiday Hindsight surveys, Jan. 2025 (Holiday 2024) and Jan. 2024 (Holiday 2023)

1 Read as: 61% of shoppers used a debit card for holiday purchases this year, up from 50% for holiday 2023.

2 The U.S. unemployment rate remained historically low at 4.1% for December 2024, via BLS.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.

Related News

Financial Innovation

Winter travel look ahead: travelers will largely stay stateside, while…

November 18, 2024

Financial Innovation

Holiday 2024: Shoppers will be celebrating sales this season

October 1, 2024

Financial Innovation

Back to school 2024: Shoppers aiming for an A+ in deal hunting

July 31, 2024