Mother’s Day 2024: expect more muted spending plans

Fewer shoppers are planning to spend ‘more’ this year compared to 2023

One-third of Mother’s Day shoppers (33%) are planning to spend ‘more’ on their purchases this year, down from 40% in 2023. Instead, more plan to spend the ‘same’ (61%), rising from last year (54%). Tempered spending sentiment is likely driven by inflation. Eight out of ten (78%) Mother’s Day shoppers indicate that inflation is impacting their purchase plans, up significantly from 2023 (74%). Despite macroeconomic challenges, seasonal opportunities still exist, particularly among younger generations of shoppers.

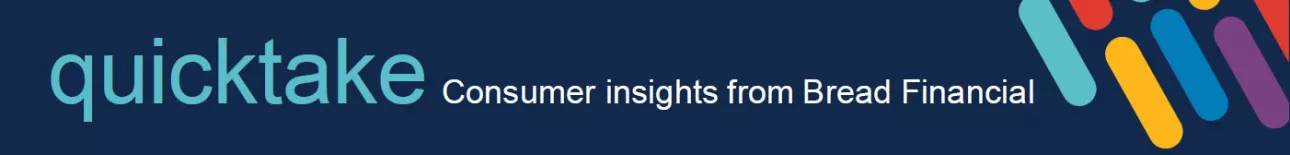

Spending more

While Mother’s Day spending plans overall are muted compared to 2023, Gen Z and millennials are maintaining more bullish outlooks than their older counterparts, with their plans to spend ‘more’ exceeding the overall average

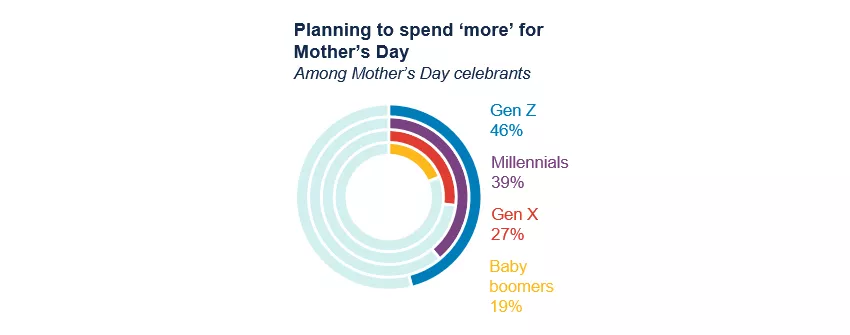

Celebrating ‘me’

While parents (62%) and spouses/partners (29%) top the list of Mother’s Day gift recipients, more than one in ten (16%) are planning to treat themselves this year. This is particularly true among millennials (21%), who are in their prime child-rearing years.

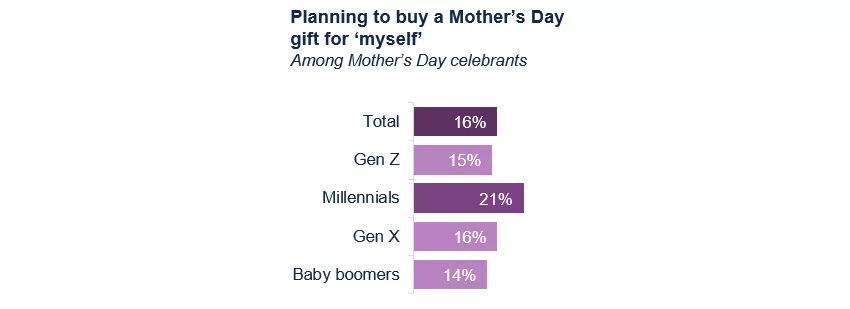

Considering credit

Younger generations are also the most likely to be swayed into spending more than intended if the right credit card option (e.g., special cardholder discount, 0% financing or convenience of paying over time) is available to them.

Key takeaway: Navigating an uncertain spending environment

With inflationary pressures continuing to test shoppers’ spending mettle, it’s not surprising that overall Mother’s Day purchase intentions are drawing back a bit this year. However, it’s also clear that not all shoppers are reacting in the same way. Whether it’s due to life stage, socioeconomic status or just general affection for Mother’s Day, it’s important for retailers to home in on these pockets of opportunities throughout the year to ring up sales during uncertain times.

Source: Bread Financial proprietary study, Mother’s Day Look Ahead survey, April 2024.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.