Quicktake: What can we expect from shoppers in 2026 based on holiday shopping trends?

It’s a new year, but shoppers will likely rely on tried-and-true habits

Despite chaotic macro conditions, Holiday 2025 shoppers — once again — proved their resilience, spending in a steady, sale-driven pattern that mimicked Holiday 2024. Macro uncertainties are likely to persist in 2026, but as long as employment holds steady, we expect shoppers to continue their measured, “steady as we go” approach to spending over the coming year. Read on for three of our predictions, based on recent consumer research insights from Bread Financial’s annual Holiday Hindsight survey.

Continued price sensitivity

With 86% of holiday shoppers indicating that inflation impacted their holiday purchasing in 2025 — and 69% engaging in deal-seeking behavior as a result — expect these smart shopping strategies to continue to prevail in 2026.

Smart shopping actions taken by holiday shoppers

Shopping around for value

This year, holiday shoppers — particularly younger generations — continued to visit a variety of retail destinations as they sought the products they wanted to buy at prices they were willing to pay. Expect the value hunt to continue in 2026, with shoppers maintaining their expanded retail consideration sets.

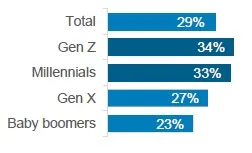

Shopped around for holiday purchase, by generation

Holiday 2025 shoppers

Using finance products strategically

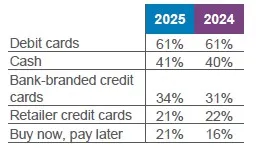

While shoppers relied on debit cards and cash to keep spending in check this holiday season, financing tools weren’t left out in the cold. Look for shoppers to consider credit cards and buy now, pay later in 2026, particularly when attached to an opportunity to earn rewards, get exclusive discounts or stretch payments over time.

Holiday shopper payment types

Select payment types shown

Key takeaway: Staying the course in 2026

Expect shoppers at large to spend in the coming year in the same measured, steady patterns they exhibited for Holiday 2025 — pinpointing sales and discounts, shopping around for value and leveraging financing tools judiciously. Retailers should stay the course in the new year: continue to acknowledge shoppers’ sensitivities to price, home in on value in their messaging and offer their best deals to their most loyal customers.

Source: Bread Financial Holiday Hindsight surveys, Jan. 2026 (Holiday 2025) and Jan. 2025 (Holiday 2024).

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.