Holiday 2024: Spotlight on in-store shoppers

Holiday shoppers are more likely to shop in stores this season than last year

According to our latest holiday research among consumers at-large, shoppers are more likely to head to physical stores this year* for gifts and other holiday purchases (68%) compared to last year (62%), continuing a trend we also saw in our recent back-to-school/college shopping surveys. While physical store shopping isn’t coming at the expense of shopping digitally (87% plan to shop digital channels this year, up from 83% in 2023), in-store shopping presents brands with one-on-one opportunities for personal engagement with these consumers.

In-store shoppers are demographically broad

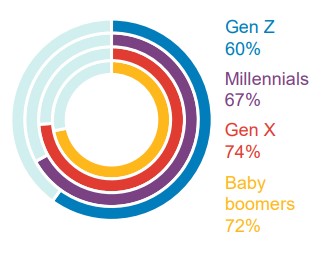

Holiday shoppers headed to stores this year reflect a wide range of shoppers. Men (69%) are just as likely as women (67%) to shop physical stores, and while Gen X and boomers are most prone to in-store shopping, the majority of Gen Z and millennial holiday shoppers plan to peruse stores as well.

Planning to holiday shop in physical stores this year

Shopping a variety of retailers

While superstores (e.g., Walmart) and online retailers (e.g., Amazon) are top destinations for those planning to shop in stores, they are more likely to shop a wider variety of other retailers, including category specialists and department stores.

Where in-store shoppers plan to shop this holiday Select retailer types shown

More motivated by sales and rewards

While holiday shoppers in general will be salebrating the season, in-store shoppers will be even more drawn to attractive deals, promotions and other incentives like rewards and cash back.

Among those planning to shop in stores for holiday…

Key takeaway: Capitalizing on the in-store opportunity

The stars appear to be aligning for a physical store shopping this holiday season. This presents brands with the opportunity to engage shoppers 1:1, not only about their products/services and general value proposition, but about their retail card programs and associated rewards/discounts as well – emphasizing the value in transacting with this form of tender, potentially driving acquisition.

Source: Bread Financial Holiday Look Ahead survey, September 2024

* In-store shoppers: Those planning to shop in stores for holiday purchases (may be shopping online as well). 2023 figures sourced from Bread Financial Holiday Hindsight survey, January 2024.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.