Holiday 2025: Let it sale! Let it sale! Let it sale!

Chaotic macro conditions are leading most holiday shoppers to seek deals, shop events and shop around this year

High prices continue as shoppers’ ghosts of holidays past, present and future. Not only do 86% say that inflation is impacting holiday purchase plans (same as last year, 87%), but 55% are also ‘extremely’ or ‘moderately’ concerned that tariffs may drive up the prices of holiday-related items further. Looking ahead, it appears that shoppers will be making merry, though aided by sales and discounts that enable them to stick to more modest budgets.

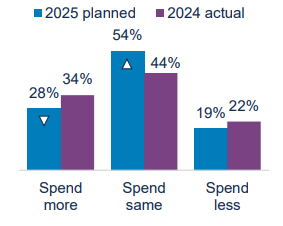

How they are spending

While more than a quarter (28%) indicate they plan to spend ‘more’ on holiday purchases this year, this is a decline from those who said they spent ‘more’ last year (34%). Instead, the majority plan to spend the ‘same’ (54%), a sign that shoppers are attempting to keep spending in check this year.

Among holiday shoppers

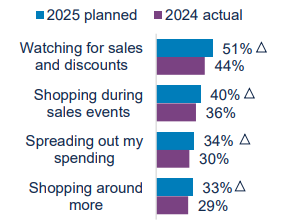

How they are saving

At the outset of the season, shoppers are signaling that they are planning to rely on a variety of smart-shopping strategies to make the most of their budgets. Most notably, half (51%) are planning to watch for sales this year, rising more than 15% over those who did so last year.

Among holiday shoppers

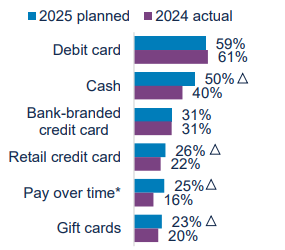

How they are paying

While budget-minded shoppers plan to lean on debit cards this year, credit cards and pay-over-time* remain viable alternatives as shoppers seek out additional benefits in terms of rewards and flexible ways to pay.

Among holiday shoppers

Key takeaway: Mindful shoppers seek exciting sales to coax spending

Holiday shoppers have made it clear that while they are concerned with elevated prices, a sale-oriented, mindful approach to shopping will enable them to tick off their shopping lists while staying on budget. Brands seeking to ring up success this season will attract the masses with compelling promotions – particularly during key events like Black Friday – while saving the most exciting, exclusive deals for their most loyal customers.

Source: Bread Financial proprietary study, Holiday Look Ahead survey, September 2025., Jul-25. Arrows indicate significant differences vs. Bread Financial Holiday Hindsight survey, January 2025.

*Pay-over-time: buy now, pay later + installment loan options

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.