Quicktake: Shoppers approach back-to-school spending with caution

Inflation and potential tariffs sound like nails on a chalkboard to shoppers

While students likely aren’t looking forward to heading back to class, back-to-school/college (BTS/BTC) shoppers don’t seem to be excited to spend for it. More than eight in 10 (86%) still say that inflation is impacting planned spending (in line with 88% LY), while looming tariffs threaten to complicate spending even more. Half (54%) indicate they are ‘extremely’ or ‘moderately’ concerned tariffs could drive prices up further.

Read on for more on how shoppers plan to approach spending in this seasonal lead up to the all-important holiday season.

Carefully spending

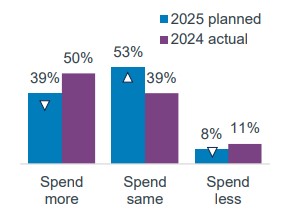

Spending plans are flip-flopping from actual spend last year. Half (53%) plan to spend the ‘same,’ siphoning from those planning to spend ‘more’ (39%). Those spending more are driven by need, specifically citing rising prices (52%) and advancing students becoming more expensive (49%).

BTS/BTC spending plans

Among BTS/BTC shoppers

Ready to pivot for high prices

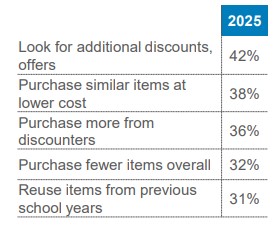

While most (75%) are planning to seek sales and shop around this year, per usual, shoppers are bracing to dig into deals further should prices be higher than expected. Trading down for cost or buying more from discounters are other top tactics.

Top tactics to offset any higher-than-expected prices

Among BTS/BTC shoppers

Considering credit

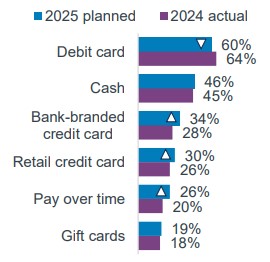

While debit cards and cash continue to be top planned payments, bank-branded and retail credit cards are also in contention, up from 2024. Plans to use pay over time* have risen YoY as well.

BTS/BTC top payments

Among BTS/BTC shoppers

Arrows indicate significant differences vs. Bread Financial Back-to-school/college hindsight survey, Sept 2024.

Key takeaway: Stirring up spending for back-to-school

While consumers at-large have shown resiliency in their 2025 spending overall, the back-to-school/college season is landing just as tariff talks are heating up again, creating an aura of spending uncertainty. Retailers seeking to build momentum headed into the holiday season should stir up spending excitement with personalized, enticing deals and offers for back-to-class, saving the most compelling discounts for their best customers.

Source: Bread Financial Back-to-school/college Look Ahead survey, Jul-25. Arrows indicate significant differences vs. Bread Financial Back-to-school/college Hindsight survey, Sept-24.

* Pay over time: buy now, pay later + installment loan options

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.