Quicktake: Pay over time has fans across all generations

Buy now, pay later/pay-over-time products have become an important tool to both consumers and retailers: during any given month, an average of one in four consumers will use BNPL/pay over time to pay for an everyday purchase under $500. And, pay over time increases consumers’ buying power and can drive incremental sales for retailers: 71% of users admit to purchasing more because pay over time made the purchase more affordable. However, there are significant generational differences in how consumers are engaging with the payment method.

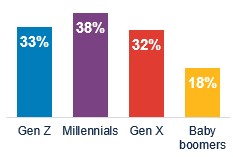

One in three pay-over-time users is increasing their usage

32% of pay-over-time users say their usage has increased this year, led by Millennials at 38%. Another 56% say their usage has stayed the same. Only 11% say their usage has decreased.

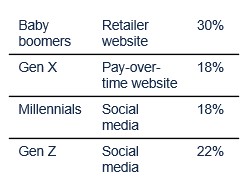

Digital channels are tops – but differ across generations

Across all generations, the top way users find out about pay- over-time is through digital channels – even for older generations. However, which digital channels are being used can differ by generation.

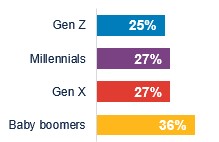

More than one in four would abandon their purchase without pay over time

If pay over time was not available for their purchase, 28% of users would abandon their carts completely, led by baby boomers (36%). Another 34% would reduce their purchase size. Just 37% would use another payment type.

Key takeaway: Retailers must offer a variety of payment methods to meet their customers’ needs

Consumers will choose the payment type that is right for them in the moment of purchase. With nearly 3 out 5 pay-over-time users abandoning or reducing their purchases if the payment type is not available, merchants and retailers can’t risk not offering the payment methods their customers want.

Source: Bread Financial proprietary study, Consumers & Payments, June 2025.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.