Quicktake: New college grads plan to celebrate by traveling

45% of new college grads* are trading their caps and gowns for getaways in the U.S. – and abroad.

While much uncertainty exists in the overarching macro-economic environment right now, new college graduates appear to be living in the moment before life in the “real world” begins. Bread Financial’s latest proprietary survey reveals that college grads are planning domestic (27%) and/or international trips (also 27%) to mark their big achievements. Combined, 45% of new college grads are planning celebratory travel; this is consistent among both male and female graduates.

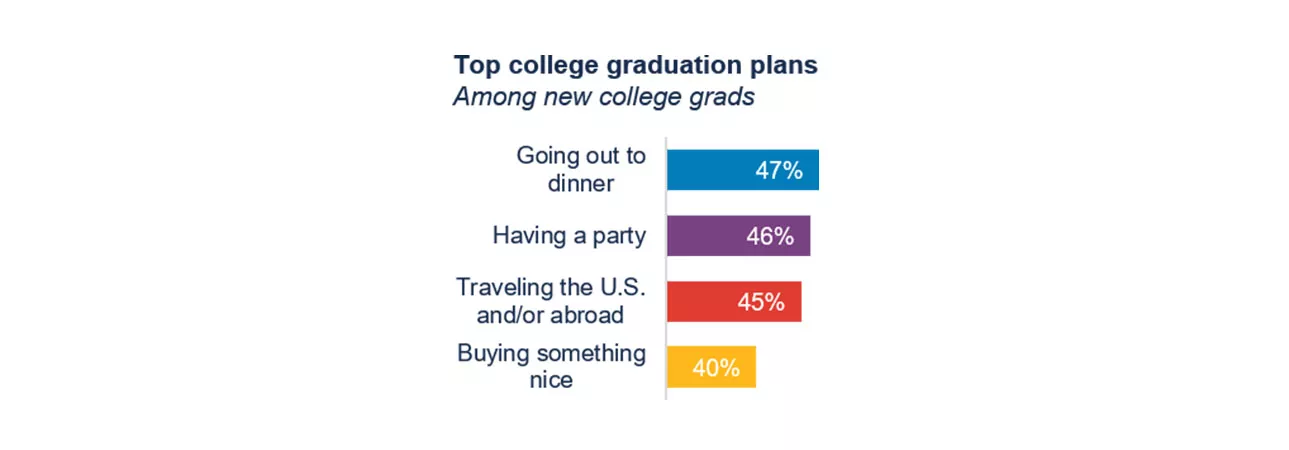

Travel is a major celebratory activity

Among new college grads, traveling the U.S. and/or abroad is a top graduation plan, in line with more traditional activities like going out to dinner or having a party.

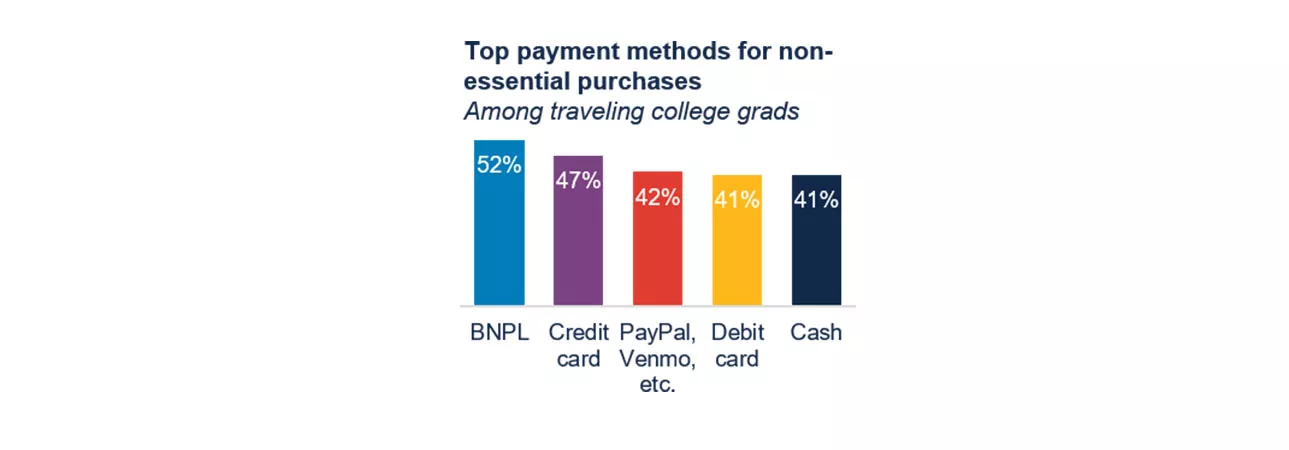

BNPL, credit cards pass the test with travelers

When it comes to outfitting a trip with apparel, suitcases and such – or even booking travel – college grads may look to buy now, pay later (BNPL) or credit cards, their top ways to pay for non-essential purchases.

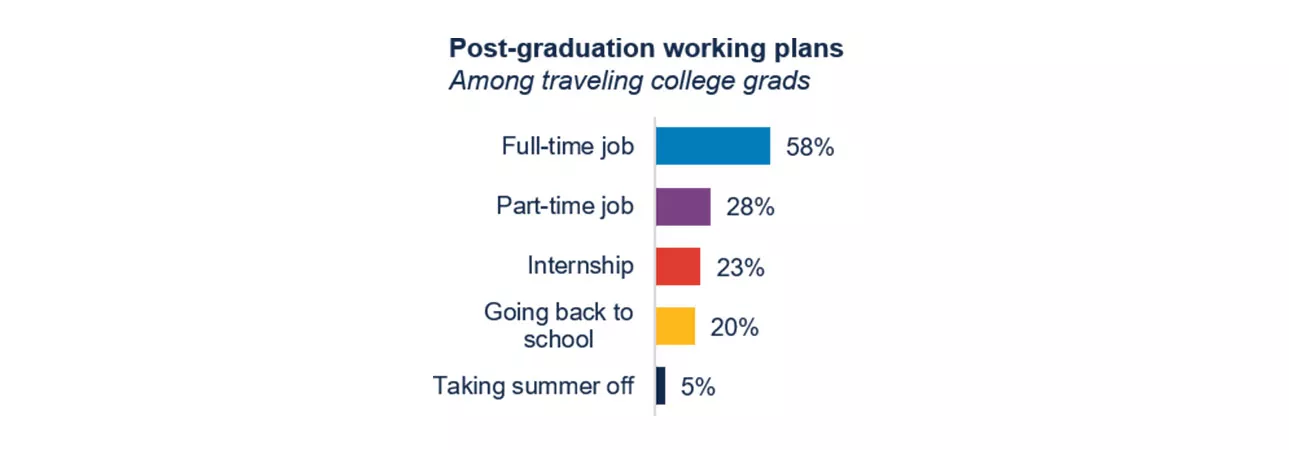

Most have secured full-time employment

Perhaps giving them confidence to take the time (and money) to travel, the majority of traveling college grads will be working new or existing full-time jobs post graduation.

Key takeaway: Homing in on niche consumer groups

While much uncertainty exists from an overarching consumer perspective, it is possible to uncover shop-and-spend opportunities among more niche consumer groups, like new college graduates. Focusing on milestone moments with meaningful messaging could be key to unlocking additional spend from these smaller groups of shoppers.

Source: Bread Financial proprietary study, College Grad survey, April 2023.

*College grads: Gen Z students (born 1997-2003) graduating from a traditional college/university or technical/trade school after spring semester 2023.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.