Quicktake: Inflation still weighs on consumers’ back-to-school shopping plans

Nine in ten (88%) of back-to-school/college shoppers indicate that inflation is impacting their back-to-class spending, consistent with 2022 (87%).

While inflation at large has begun to ease, those planning to shop for back-to-school/college (BTS/BTC) this year are still feeling the residual effects on their wallets. As a result, spending plans have tempered compared to last year, and shoppers are sharpening their deal-seeking skills.

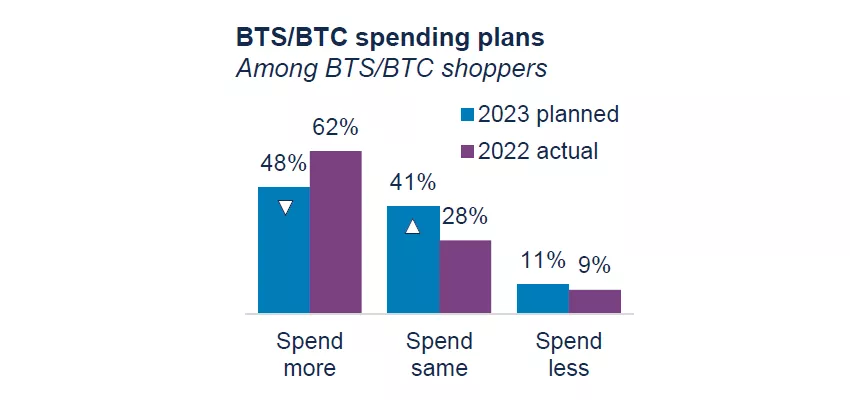

Keeping spending in check

About half (48%) plan to spend more on BTS/BTC purchases this year, down from 62% who spent more in 2022. Further, the top reasons to spend more are being driven by needs over wants: advancing students becoming more expensive (53%) and continued inflation (50%).

Watching for "prime" deal days

Three-quarters of shoppers (74%) have plans to seek deals and shop around for BTS/BTC, rising from the 69% who did so last year. This figure is largely being driven upward by sales events (like Amazon Prime Day) and a sharpened focus on discounts.

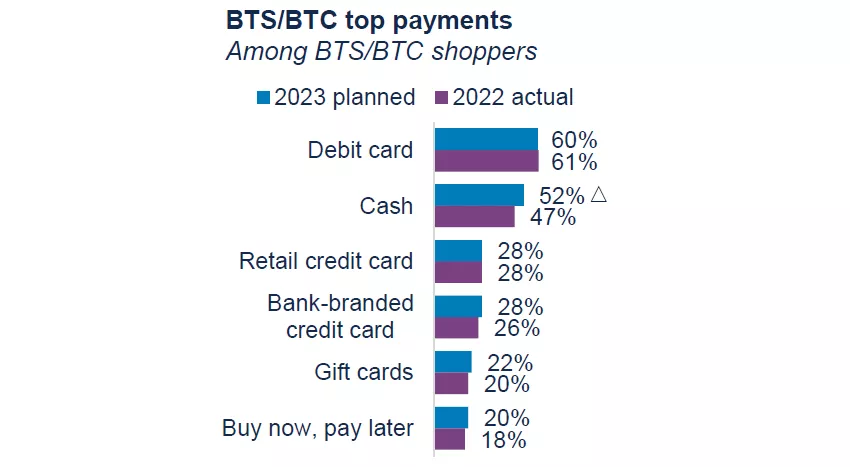

Paying with credit is clutch

While cash (including debit cards) will be king this year, credit continues to be a solid form of alternative payment. Intent to use both retail and bank-branded cards is on par with usage in 2022.

Keytakeaway: Winning back-to-class dollars

While inflation and key macroeconomic metrics, like consumer confidence, are showing signs of improvement, shoppers appear to be reining in spending where they can as they recover from the price hikes that have plagued them over the past two years. Brands vying for back-to-class dollars should lead with promotional strategies that appeal to the larger audience, but save the very best offers for their most loyal customers.

Source: Bread Financial proprietary study, Back-to-school/college Look Ahead survey, Jul-23. Arrows indicate significant differences vs. Bread Financial Back-to-school/college Hindsight survey, Sept-22.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.