Holiday 2022: Gen Z is eyeing buy now, pay later for purchases

With the holiday season upon us, let’s take a closer look at the buy now, pay later (BNPL) plans among the youngest group of shoppers.

Bread Financial proprietary research reveals that 24% of Gen Zers (born 1997-2004) plan to leverage BNPL for holiday purchases, up from the 14% who used it for holiday 2021.* Compared to the Gen Z cohort at large, potential Gen Z BNPL users are significantly more likely to indicate that they’re seeking special financing terms specifically because they’re spending more on essentials like food and gas (39% versus 24%). Despite inflation’s impact, this Gen Z subset doesn’t seem to be feeling ho-ho-hum about their approach to holiday shopping. Rather, potential Gen Z BNPL users are gearing up to be active, engaged shoppers over the holiday season.

Digitally minded

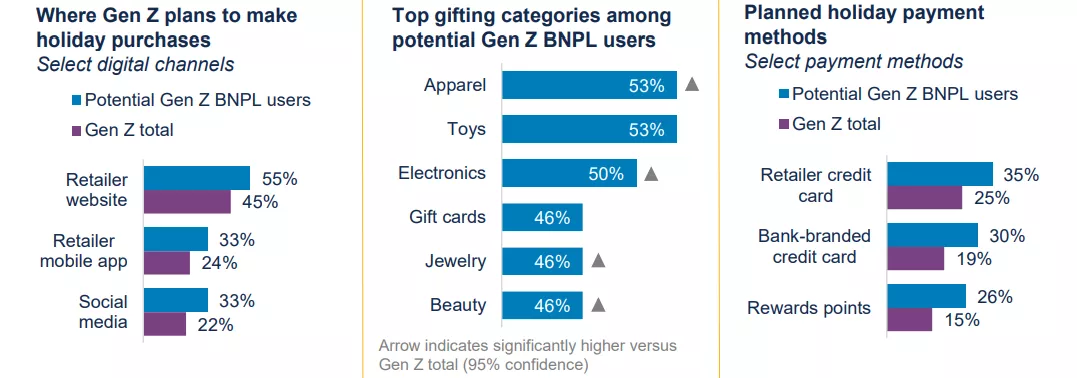

While Gen Z is generally digitally savvy, this is even more evident among potential BNPL users, who are more likely to purchase for holiday via online outlets.

Longer shopping lists

Potential Gen Z BNPL users plan to purchase from a wider array of categories (average: 6.5) than Gen Z shoppers overall (4.9), perhaps also driving the need for the financing tool.

Options to pay

Compared to Gen Z at large, potential Gen Z BNPL users are also significantly more likely to lean into other financing tools (like credit) as well as rewards points.

Key takeaway: Making merry with Gen Z shoppers

While Gen Z is still coming into its own in terms of spending power, understanding their payment needs now could be a building block for driving deeper engagement in the years to come. While the holiday shopping season is well underway, ensuring that BNPL offerings — as well as other financing tools, like retail credit cards — are clear and easy to use could be key to ringing up sales and unlocking additional spend with these young shoppers.

Source: Bread Financial, Holiday Look Ahead survey, September 2022

*Bread Financial, Holiday Hindsight survey, January 2022

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

To learn more about Bread Financial, our global associates and our sustainability commitments, visit breadfinancial.com or follow us on Instagram and LinkedIn.