Quicktake: Holiday shoppers are already on the move

Holiday 2022: Shoppers are already on the move

As of early September, 21% of shoppers had started their holiday shopping.

While Halloween is still on the horizon, a significant number of shoppers are thinking ahead to their holiday purchases. One in five shoppers (21%) has begun their holiday shopping. This is consistent across the major generational cohorts (Gen Z, millennials, Gen X and baby boomers). By the end of October, 55% of shoppers will have started shopping, and millennials (63%) are most likely to lead these “early bird” tendencies. Read on for more first-look insights as the biggest shopping season of the year approaches.

Spending more

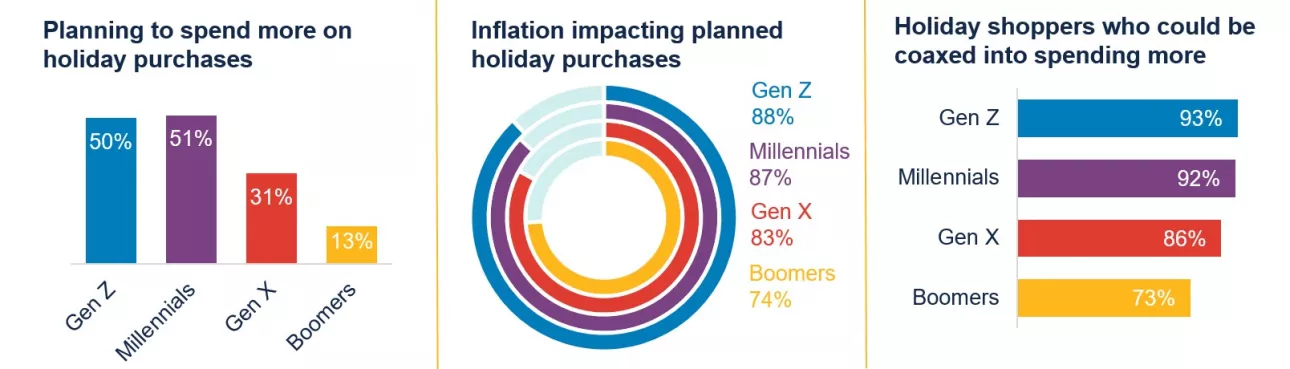

About a third of shoppers (36%) plan to spend more on holiday purchases this year compared to last. Gen Z and millennials are gearing up to be holiday’s most bullish spenders.

Watching inflation

Shoppers’ spending outlook is undoubtedly complicated by persistent inflation. Eighty-three percent said that price hikes are impacting purchase plans. Gen Z and millennials are driving this figure.

Willing to spend

Despite inflation, 86% say they could be coaxed into spending more than planned if offered additional perks (e.g., free gift, cardholder discount) or financing via BNPL or credit card.

Key takeaway: Getting a jump on holiday sales

While shoppers — so far — continue to exhibit a willingness to spend despite persistent inflation, the key to ringing up holiday sales will be ensuring that the emotional component of getting a “good deal” is satisfied. While a percentage discount may go a long way with shoppers, other aspects — great customer service, seamless online experience, emphasis on value (read: quality) — could also buoy solid sales without devolving into price wars with competing retailers.

Source: Bread Financial, Holiday Look Ahead survey, September 2022

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.