66% of Gen Z women feel they’re on the “right track” financially

While Gen Z women are relatively confident in their finances, many still admit to learning challenges in their financial education.

In new proprietary consumer research with our partners at Ruling Our eXperiences (ROX), we set out to understand the financial acumen and confidence among women across generations, including decision-making and planning for the future — as well as how they learned, or are learning, about money management. Read on for insights about how Gen Z women (age 18-27) specifically are approaching their financial journeys.

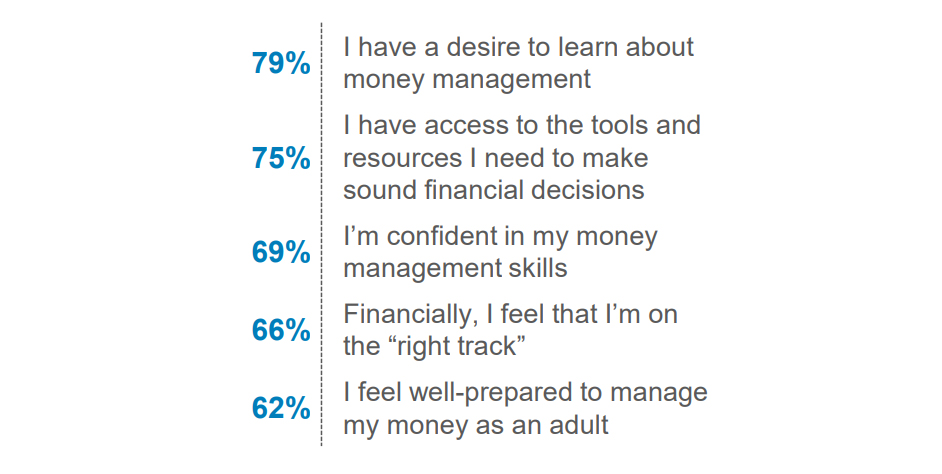

Overall, financially confident

Overall, about two-thirds of Gen Z women are confident in their money management skills and feel that they’re on the “right track” financially. This is perhaps buoyed by the fact that most (79%) indicate they have a desire to learn about money management.

Gen Z women who strongly agree/agree

Select statements shown

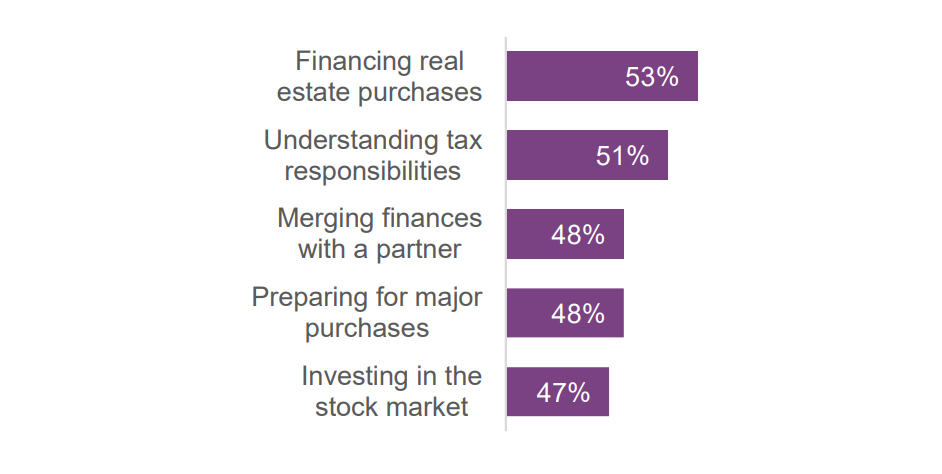

Learning the financial basics

Gen Z women are most likely to be learning the financial basics, like spending money wisely (55%), saving for emergencies (51%) or using credit cards responsibly (48%). Many topics remain on their learning radar, though (below).

Financial topics that Gen Z women plan to learn about

Top topics shown

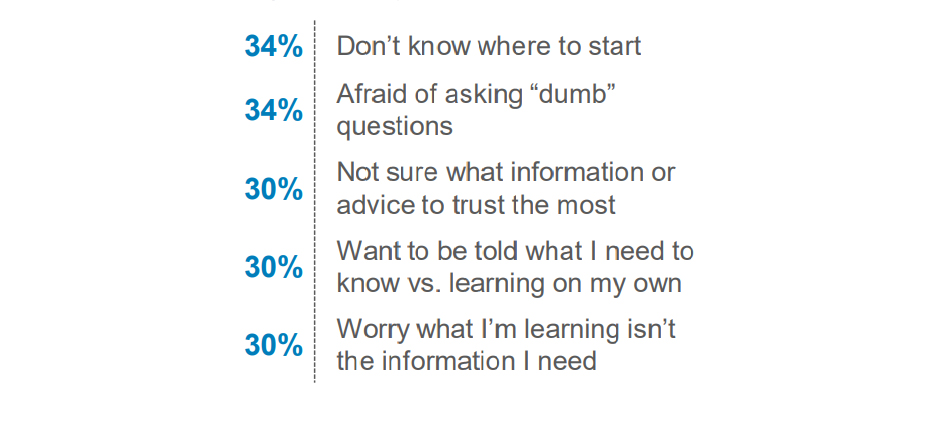

Challenges to learning

While the majority of Gen Z women feel financially confident, this group still admits to challenges in honing their money management skills. Many admit that they just don’t know where to start or are afraid of asking “dumb” questions.

Challenges Gen Z women face when learning about money management

Top challenges shown

Key takeaway: Building a confident financial mindset

While many Gen Z women feel like they’re on the right financial track, one in three admit that they still just don’t know where to start on their financial learning journey. To foster an effective learning environment, marketers should consider how to help pace and prioritize the learning process with engaging content and tools that help inspire trust in their brands — and confidence within these learners.

Source: Bread Financial Women’s Index Survey, August 2024.

About Ruling Our eXperiences, Inc. (ROX)

Ruling Our eXperiences, Inc. (ROX) is the national authority on research, education and programming centered on girls. ROX puts data into action to create generations of confident girls who control their own relationships, experiences, decisions, and futures. ROX delivers school-based programs in 650+ schools across 40 states and operates the ROX Institute for Research and Training. For more information about ROX, visit www.rulingourexperiences.org.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.