Fall travel look ahead: Avoiding the heat and crowds

Fall travelers are traveling off-peak to get a bargain

Nearly half (43%) of fall travelers will spend between $1,000 - $5,000 on their trip, compared to 47% of summer travelers spending the same. Known as “shoulder season” for mild weather and cheaper prices, 35% said they are traveling in the fall to avoid the heat and 30% said it was to avoid peak summer prices. That said, some will be using their fall trips to splurge: 12% will spend over $10,000 on their trip, compared to 8% who planned to spend the same during their summer travels.

Rewards connect emotionally Travelers not sold on artificial intelligence (AI)

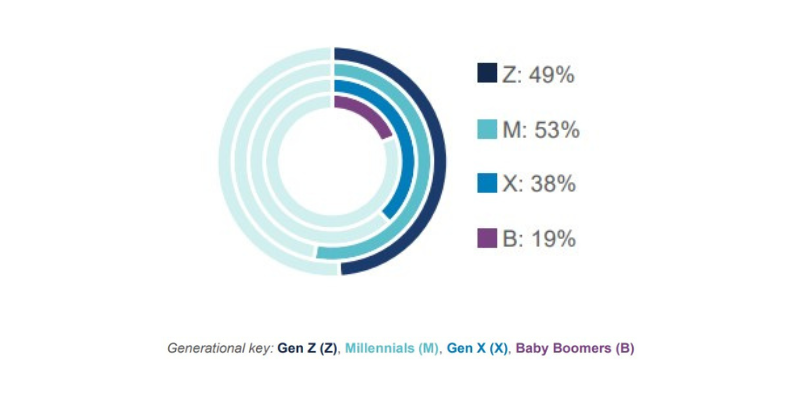

Consumers are evenly split on whether they would let AI build a travel itinerary for them, with 40% saying yes, 41% saying no, and 19% saying they were unsure. Younger travelers were more open to a digital assist.

Open to using AI to build travel itineraries

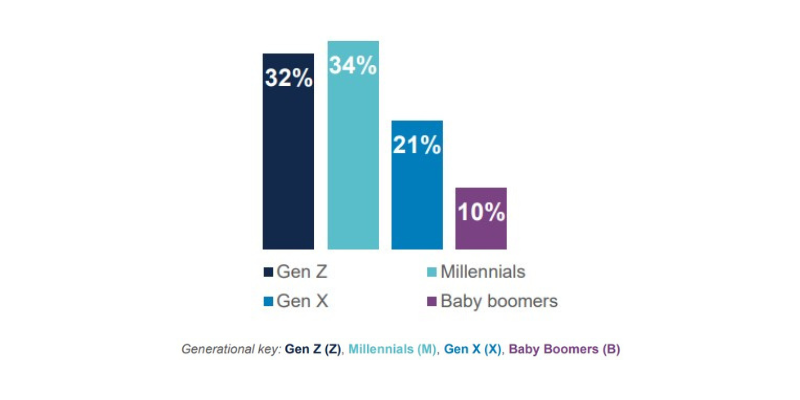

Big spenders are most likely to be younger

Nearly half (43%) of fall travelers expect to spend between $1,000 and $5,000 on their trips. Millennials and Gen Z are most likely to spend more: 3 in 10 will spend more than $5,000 on their trip.

Spending more than $5,000 on vacation

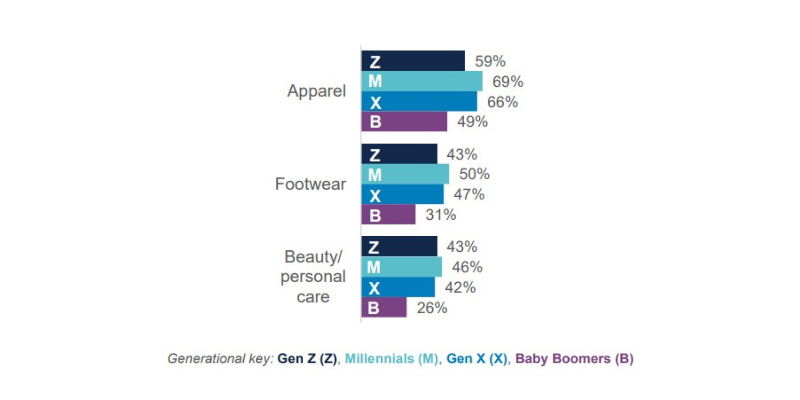

Nine in 10 shopping to prepare for their trip

To get ready for their trip, 88% of fall vacationers are going shopping. Apparel (61%), footwear (43%) and beauty/ personal care products (39%) are top purchase plans, led by millennials.

Pre-vacation shopping plans

Key takeaway: all travelers are looking for something better

Across all generations, 81% of travelers chose the fall for a better experience, including better weather, fewer crowds, better prices and more. Brands can tap into these feelings using messaging and imagery that affirms travelers’ sound choices, and by highlighting products and services that offer the best value.

Source: Bread Financial proprietary study, Fall Travel Look Ahead, August 2024.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.