Evolving expectations for retailer credit card rewards redemption

New proprietary consumer research from Bread Financial reveals that retailer-branded credit cardholders want more control over their rewards redemption experiences.

As something that can fundamentally save them money or more superficially spur a ‘treat-yourself’ moment, retailer-branded credit cardholders (including both cobrand and private label cardholders) feel emotionally connected to the rewards they earn on purchases. As such, they’d like a little more say in the when and how they can redeem these rewards.

Rewards connect emotionally

Retailer credit card rewards aren’t ordinary coupons; they are earned benefits that cardholders look forward to spending. As such, nearly nine out of ten shoppers feel ‘excited’ or ‘good’ when they receive a retailer credit card reward or have points to redeem.

Generally, how do you feel when you receive a retailer credit card reward or have enough points to redeem for a reward? … Select statements shown

Rewards expiration is a pain point

Expiration dates attached to many retailer credit card rewards tend to make cardholders feel rushed to spend or like they are missing out on better opportunities to use their rewards, such as birthdays or holidays

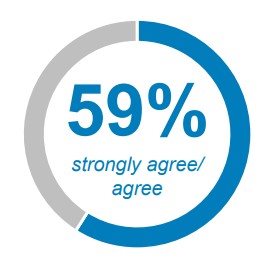

I wish I had more time to redeem my retailer credit card rewards before they expire

Rewards could be more versatile

Most retailer credit cardholders (52%) say that rewards exclusive to a retailer meet their needs. However, a significant proportion (25%) would still like opportunities to redeem rewards outside those retailers, such as options for cash back or statement credits.

I would prefer the opportunity to redeem my retailer credit card rewards outside of that retailer

Key takeaway: Enhancing the retailer credit card rewards redemption experience

Here’s the bottom line: Two in five cardholders who experienced pain points like expiration or desired greater rewards versatility indicated they’d be willing to use their retailer credit cards more often for purchases if these items were addressed. So, not only could enhancing the rewards redemption experience result in a win for cardholders, but it could very likely lead to a win for brands as well.

Source: Bread Financial Loyalty + Rewards Redemption survey, May-24

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.