Consumers’ new view on corporate responsibility

Shoppers still expect brands to 'do the right thing' but are growing increasingly price sensitive about supporting these efforts with their wallets

Three out of four shoppers (77%) believe that companies, including brands, have a responsibility to ‘do the right thing’ when it comes to issues regarding the environment and social responsibility, consistent with our 2023 survey (76%). However, with macro influences like inflation continuing to test shoppers’ spending mettle, it appears that shoppers are increasingly preferring to support these efforts from the sidelines.

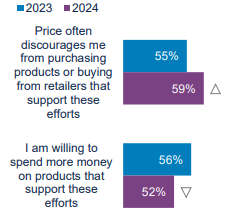

Becoming more price sensitive

Compared to last year, price is a growing tension on consumers’ willingness to spend to support brands’ environmental or social responsibility efforts.

Regarding buying from brands or purchasing products that support environmental or social responsibility efforts … Strongly agree/agree

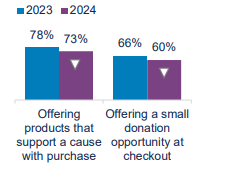

Leaning into passive support

Further, when asked outright, shoppers generally preferred a more passive approach to supporting brands’ cause-related efforts than actively backing these stances with their own spend.

Shopper preference for passive vs active support

Considering credit Expecting action from brands

While budget-focused shoppers are relying on debit cards and cash this year, bank-branded and retail credit cards are solid alternative options, up from and on par with 2023 usage trends, respectively.

Initiatives like using eco-conscious shipping materials (81% vs 81% LY) or paper bags instead of plastic (76% vs 74% LY) are still highly influential actions that show shoppers that brands are ‘doing the right thing’ -particularly while the influence of support-with-purchase efforts remain subdued.

Influence of support-with-purchase efforts on shoppers

Key takeaway: Engaging shoppers while recognizing potential financial constraints

The macroeconomic environment, specifically inflation, is wearing on consumers and what they are willing (and able) to spend. It’s important for brands to recognize how price sensitivity is affecting their core customers and respond with appropriate cause-related marketing efforts – acknowledging that shoppers may prefer more passive participation for as long as economic headwinds persist.

Source: Bread Financial proprietary study, Brands + Corporate Responsibility survey, Jul-24. Arrows denote significant changes from 2023 Bread Financial Brands + Corporate Responsibility survey, Aug-23.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.