Quicktake: Consumers are budget-weary, but still planning spring and summer travel

Inflation has made an impact on 65% of consumers with spring/summer plans

Of all consumers planning to take time off during the warmer months, 80% will be taking a vacation, while 20% will be staycationing. Budget is front and center for nearly all: nearly 7 in 10 say inflation has made an impact on their plans, and travelers are making adjustments to their plans to cope: 36% will spend less, 34% reduced their budget, and 29% will do fewer activities.

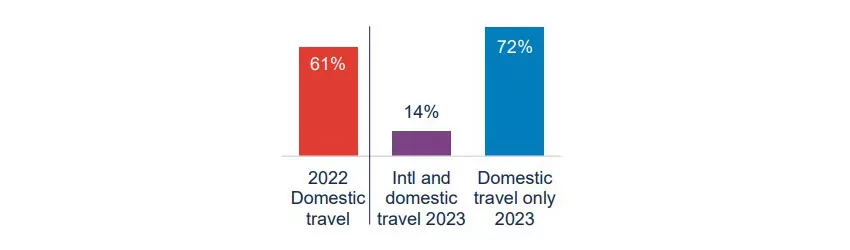

More plan to travel domestically

86% of vacationers are planning a domestic trip, including 72% who plan to travel only domestically, and 14% traveling both in and out of the country. This compares to 61% who said they traveled domestically last year. Consumers’ international travel plans dropped slightly, going from 31% to 28%.

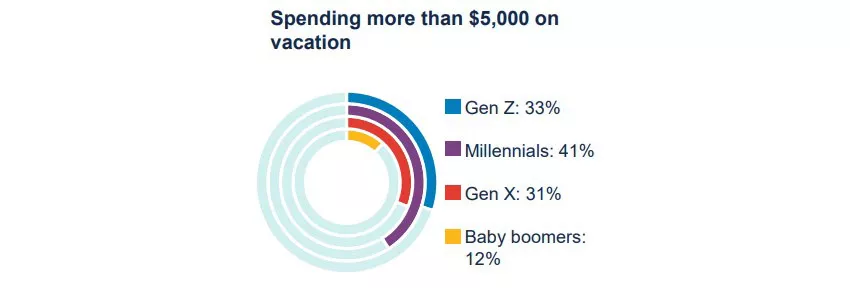

Big spenders are most likely to be Millennials

67% of vacationers expect to spend less than $5,000 on their trip. Millennials are most likely to spend more: 41% will spend more than $5,000 on their trip, with 13% specifically expecting to spend more than $15,000.

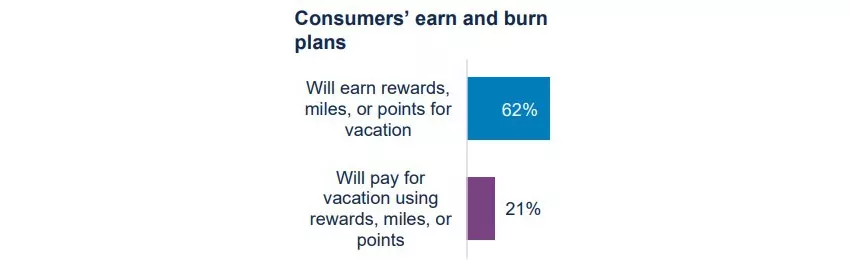

More earning than burning rewards

62% of vacationers expect to earn rewards for their travel, led by Millennials at 69%. Only one in 5, though, will pay for their vacation, including associated activities and goods, using miles, points, or rewards.

Key takeaway: Vacation is a bright spot for consumers

Inflation has been grinding on, but consumers are not wiling to give up their vacations – they are just spending differently, focusing more on domestic travel and looking for savings opportunities. In addition to value-focused messaging, brands should shine a spotlight on their loyalty programs: ensure your customers know all of the ways they can earn and spend their rewards.

Source: Bread Financial proprietary study, Spring/Summer Travel Plans, February 2023

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.