Mid-year update: The State of the American Shopper

Shoppers are continuing to show resiliency

Tariff concerns and persistent inflation have taken a significant toll on consumers, sapping savings and reducing their purchasing power. Despite the squeeze, the consumer picture is not all gloom: compared to October 2024, today’s consumers feel a little sunnier, continuing to demonstrate their resiliency in the face of significant headwinds.

Sentiment sees a bump of improvement

As of April, 30% of consumers describe the economy as very good to excellent, a slight increase from 28% October. They are feeling better about their personal economies as well: most consumers (76%) believe they’re on the right track personally, a jump from 69% in October. The younger generations are leading in terms of positive sentiment: 47% of Gen Z and 43% of millennials describe the economy as excellent to very good, compared to only 29% of Gen X and 14% of Baby boomers.

Consumers continue to signal growing interest in stores

The number of consumers saying they are shopping in stores more frequently (33%) continues to outpace the number of consumers saying they are shopping online more frequently (25%). The generation most likely to say they are shopping in stores more is Gen Z at 43%, followed by Gen X at 36%, millennials at 34% and lastly Baby boomers at 25%.

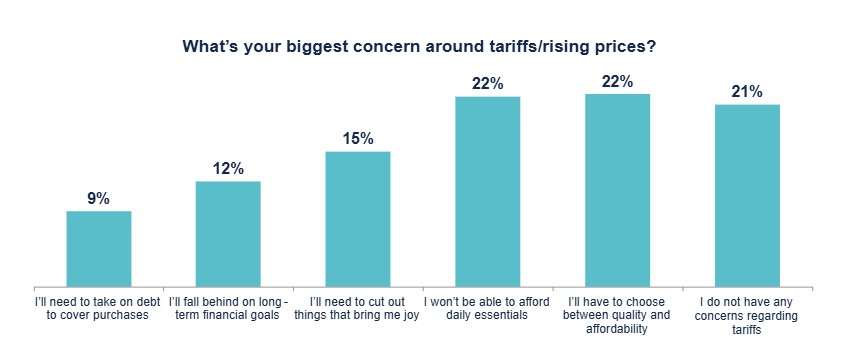

Tariffs are causing anxiety

For the first time, “government policy and decision-making” was a top economic concern, with 50% worrying about that, compared to 40% in October. Eight in 10 consumers report being concerned about the impact of tariffs and 64% made preemptive purchases to get ahead of potential price increases.

Consumers maintain engagement with most financing tools

Compared to October, the number of consumers using bank-branded credit cards (44%) and retail store cards (29%) remained flat. Users of buy now, pay later/pay-over-time products fell slightly to 18% from 22% in October.

Key takeaway: Now is the time to be obsessed with your customers’ needs

With higher prices firmly entrenched, consumers are carefully considering where and how to spend their dollars. Brands must offer compelling value, a satisfying experience, and the payment options that meet their customers’ needs in the moment of sale.

Source: Bread Financial proprietary study, The State of the American Shopper Mid-Year Update, June 2025.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.