Quicktake: Younger generations expected to drive Valentine’s Day spending

Look to Gen Z and millennials to drive spending momentum this year.

Following the recent holiday season, which saw modest gains in retail sales, shoppers appear to be approaching Valentine’s Day with a similar mindset. Overall, fewer celebrants plan to spend ‘more’ this year (34%) than in 2025 (38%), while the majority plan to spend the ‘same’ (57%, versus 55% last year). Few (9%) plan to spend ‘less,’ though this is a marginal increase from last year (7%). However, while Valentine’s Day spending plans overall are a bit less bullish for 2026, it’s still looking a lot like love among Gen Z and millennials.

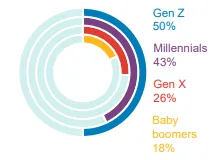

Spending more

While fewer celebrants overall (34%) plan to spend ‘more’ on Valentine’s Day purchases this year, a closer look reveals that Gen Z and millennials are bringing more heat with their own plans to spend.

Planning to spend 'more' for Valentine's Day

Among Valentine's Day celebrants

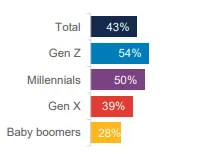

Considering credit

Reinforcing their willingness to spend, Gen Z and millennials are significantly more likely to indicate that a compelling credit card offer (e.g., special discount, 0% financing or pay-over-time convenience), could entice them to spend more on Valentine’s purchases than anticipated.

Credit card offers (net) could entice additional Valentine's spend

Among Valentine's celebrants

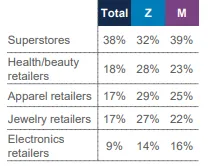

Shopping around

Gen Z and millennials also plan to put more heart in their search or the perfect Valentine’s purchases. While superstores are the top Valentine’s Day retail destination across generations, younger cohorts also plan to shop a wide variety of category specialists.

Select Valentine's retail destinations

Among Valentine's celebrants

Key takeaway: Building the relationships

More modest spending plans for Valentine’s Day among consumers at-large could be a sign of trends to come over 2026. However, identifying and leaning into key areas of opportunity—in this case, Gen Z and millennials—could help savvy retailers connect with new shoppers and provide the foundation for long-lasting customer relationships.

Source: Bread Financial Valentine’s Day Look Ahead survey, January 2026.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.