Sentiment may be bottoming out, tariff related buying slowing, consumers await price impacts

- Consumer confidence and sentiment have rebounded as tariff-related fears have calmed some on the back of the recent UK trade deal and indications of progress with China. That said, tariff risks remain real with the expiration of the reciprocal tariff pause on July 9 and the current administration signaling a willingness and readiness to enforce tariffs on trading partners that have not “made a deal” or significant progress by that date.

- In the meantime, consumers are willing to set tariffs aside and resume more normal spending as indicated by the May retail sales numbers. While inflation adjusted sales were down to last month and only marginally better over last year, that softness can be attributed to a combination of three factors:

- Lower auto sales after the tariff-induced buying in March.

- Continued lower gas spending as prices remain comfortably below last year and a similar situation for grocery spending with food inflation relatively tame.

- A drop-off in restaurant spending, month over month from the Easter shift driving higher restaurant spend in April this year.

Employment picture generally stable, wages outpace inflation and savings rate rebounds

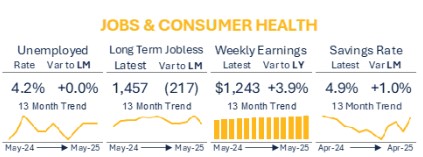

- Key “hard” data elements continue to show resilience and strength from an employment and wage perspective.

- Employment remains strong, flat to April at 4.2%, which when combined with labor force participation (not shown here) continued to point to a full employment economy.

- Long-term jobless improved markedly in May, dipping below 1.5 million in May. If this trend can hold, especially with some slight increases in the weekly unemployment claims numbers, that bodes well for consumer and corporate strength for the months to come.

- Wage growth in terms of weekly earnings were strong at 3.9%, eclipsing inflation by over 150 basis points. With wage growth significantly above inflation, the opportunity for consumers to stay ahead of inflationary pressures increases and can further strengthen resiliency, especially in the face of potential price pressure from tariffs.

- Between higher wages and lower month-over-month spending, the savings rate increased to nearly 5% in May. This remains important as households still need to rebuild depleted savings, and any consistent improvement here is a sign that households are actively working to achieve better economic equilibrium.

CPI improved again; only Sticky categories remain above 3%

- Overall CPI was relatively stable in May, up 0.1% to April at 2.4%, with strong improvement in fuel & gas.

- Egg prices continued to improve while other grocery categories saw some pressure, especially cereals and bakery products.

- Food away from (fast food, fast casual, restaurant) increased 0.3% month over month but remains only modestly higher than last year at 2.2%. Within core, up 2.8% over the prior year, shelter increases continued to slow to a 3.9% annual increase, still above the Fed goal, but moderating. Auto (both new and used) were down as was apparel.

- Other categories with notable increases over last year include auto insurance (+7.0%), home furnishings (+2.7%) and medical care (+2.5%).

- Despite lower airfare, down 2.7% in May after declining 2.8% in April as well, travel volumes remain more modest than last year suggesting some caution on the part of consumers and potentially business travel.

Disclaimer

This summary is provided for informational purposes only and does not give and should not be construed as giving business, investment, legal, tax or other advice. This presentation has been prepared without taking into account the financial or business objectives, situation or particular needs of any particular person. Without limiting the generality of the foregoing, Bread Financial is making no projections or statements about (1) the future financial performance of any company or Bread Financial, (2) the development of any company’s or Bread Financial’s business, or (3) how any of the information may affect any company’s or Bread Financial’s business. The information is presented for the recipient to evaluate, and Bread Financial disclaims any responsibility for any reliance on the information – all recipients of the information should independently review and research the information presented, evaluate their own information and information from other sources, and reach their own independent conclusion. Actual events and outcomes could differ materially from those anticipated in this presentation. This presentation constitutes confidential information and is provided to you on the condition that you agree to hold it in confidence and not copy, reproduce, disclose or distribute it in whole or in part without the prior written consent of Bread Financial.

Definitions & Sources

- CPI is sourced from the Bureau of Labor Statistics with additional insight on Sticky Inflation coming from the St. Louis Fed – FRED (Federal Reserve Economic Data) based on their public releases.

- The orange line for Sticky Inflation represents the target rate that the Fed has publicly stated.

- Consumer Sentiment is sourced from the monthly University of Michigan survey and due to timing of release tends to run ahead of Consumer Confidence which is sourced from The Conference Board monthly survey.

- Real Retail Sales comes from FRED with inflation indexed to 1982-1984.

- Unemployment data on both the unemployment rate and the number of persons dealing with long term unemployment (27+ weeks) are both sourced from FRED.

- Weekly wage data is the nominal (not inflation adjusted) weekly wages reported by FRED from the Bureau of Labor Statistic monthly release and is a combination of weekly work hours and hourly wages and is only private industry data (does not include government wages).

- Savings Rate data is also sourced from FRED and is sourced from the US Bureau of Economic Analysis based on their Personal Income and Outlays release.

- All commentary is proprietary to Bread Financial and reflects Bread’s assessment or summation of publicly available data, commentary, and resources combined with Bread’s perspective based on this data and other proprietary data sources.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.