Quicktake: Harnessing social media to drive retailer credit card awareness

According to new research, social media was the top way Gen Z became aware of the last retailer credit card they applied for.

When it comes to marketing retailer-branded credit cards, promoting card awareness using social media may not be as commonly used compared to more traditional tactics (e.g., email, direct mail, store signage). However, new research* reveals that social media – particularly when boosted by social media influencers – is a potentially powerful tool brands can leverage to drive awareness of their card products, particularly among Gen Z.

Social media as a top awareness driver

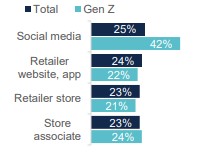

One in four respondents (25%) indicated they became of the last retailer credit card they applied for via social media. This figure rose dramatically among Gen Z.

Top ways respondents became aware of the last retailer credit card they applied for Among respondents who have and use retailer-branded credit card(s) for everyday or big-ticket purchases

Most popular platforms for engagement

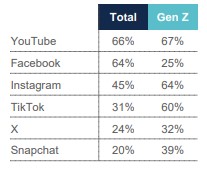

With social media an awareness driver, brands should consider the platforms their target audiences are engaging in. While YouTube (66%) and Facebook (64%) are most popular overall, Gen Z’s presence on Instagram and TikTok is well above average.

Top social media platforms respondents regularly use

The additive value of influencers

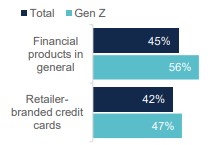

Additionally, a substantial portion of respondents indicated that influencers are appealing as potential informational sources for financial products generally as well as retailer credit cards –these figures rising among Gen Z as well.

Find social media influencers appealing as a potential source of information for… Very/somewhat appealing

Key takeaway: Influencing the social connections

Social media is a powerful marketing tool to engage shoppers and drive awareness of retailer-brand credit cards. With additional amplification via social media influencers, brands can reach beyond their owned channels, raising awareness further – potentially among new audiences. To elevate current social media marketing efforts, brands should consider partnering with influencers to bring new levels of authenticity, relevance and reach to promoted card products that previously may have been unachievable with marketing via their owned social channels.

Source: Bread Financial Influencer Marketing survey, March 2025.

* To qualify for the survey, respondents had to have an existing Co-Brand or Private Label credit card, or be open to applying for one, AND be active on social media.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.