Quicktake: Consumer spending & tariffs

Consumers are taking steps to get ahead of potential price increases.

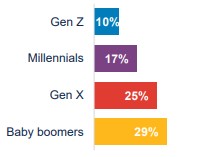

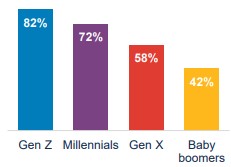

The prospect of tariffs increasing the cost of goods has rattled consumers’ confidence, causing them to take stock of their pantries, closets and garages. In response to this economic uncertainty, 44% of consumers say they are increasing their savings. But this doesn’t mean their wallets have snapped shut: 64% have sped up planned purchases or stocked up on goods ahead of potential price increases. This preemptive purchasing is led by younger consumers, including Gen Z (82%) and millennials (72%).

Consumers are stocking up

Seven in 10 consumers (64%) are making purchases ahead of the tariffs. They are buying groceries (36%), electronics (24%), apparel (19%), beauty/personal care (17%) and even cars/trucks (12%).

Made planned purchases earlier or stocking up

Some plan to increase their spending this year

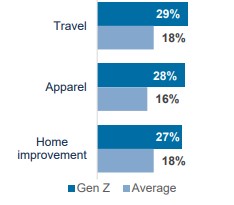

Looking at future plans, some consumers expect to spend more on travel (18%), home improvement (18%), apparel (16%), and electronics (15%) this year. Many of these increases are led by Gen Z.

Gen Z leads across plans to spend more

The one thing consumers won’t give up: their coffee

Regardless of what’s happening with the economy, most consumers still have one thing they won’t do without. Their top pick: coffee (20%). This was true for all generations, except Gen Z, who put beauty/personal care in their top spot (16%).

Not giving up their coffee

Key takeaway: Consumers continue to spend on their priorities

With potential price increases looming, consumers haven’t put the brakes on shopping – just yet. Instead, they are examining their priorities and spending accordingly. Savvy brands will lean into their customers’ necessities, focusing on the products they can’t do without – at a value they can afford.

Source: Bread Financial proprietary study, Consumer Spending & Tariffs, April 2025.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.