Partner

Plunge

Overview

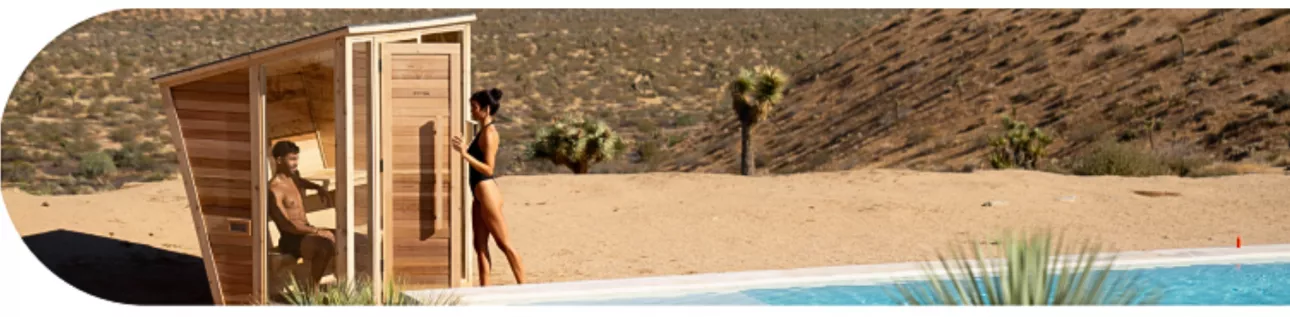

A cold plunge tub retailer focused on boosting customer wellness with at-home solutions.

Opportunity

Breaking the ice with potential customers can be tricky when your baseline model retails for more than $4,000. Plunge, the Shark Tank-acclaimed makers of cold plunge tubs, didn’t want cost to be a barrier for customers interested in their at-home wellness products.

While pay-over-time financing was something they had historically offered their consumers, Plunge was in search of the right partner — a partner who could provide convenient, easy-to-use financing that allowed their customers to take the plunge, but also a partner that would be strategically aligned to their goals and offer a more hands-on support model.

Bread Pay® from Bread Financial® offered the perfect solution with their installment loan financing and white glove partnership approach.

The right financing partner for the job

Offering a financing solution that allows customers to take home Plunge’s innovative, industry-leading wellness solution was only one piece of the puzzle. Plunge was also looking for a true strategic partner that was invested in their business and their growth.

With Bread Pay® financing in place, performance quickly outpaced Plunge’s previous provider. Driven by several factors, including higher approval amounts, a wider array of loan terms, and an overall improvement to servicing for both the customer and merchant, Plunge began to see the impact of a well-rounded payment solution.

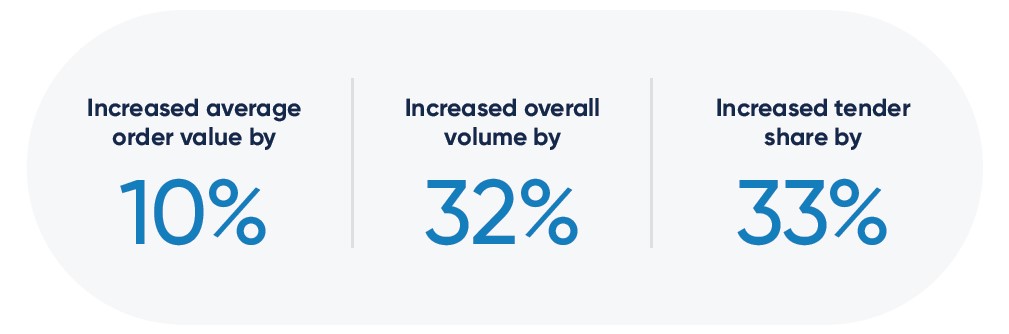

When compared with Plunge’s previous pay-over-time provider in an A/B test, the Bread Pay partnership has*:

Increasing customer buying power with a merchant-first approach

In partnership, Plunge and Bread Pay® created a custom financing program that would allow customers to unlock spending power specific to the Plunge product set. With the appropriate Bread Pay financing options in place, Plunge was not only able to close the deal with more customers, but quickly began capturing additional volume from model upgrades and accessory purchases.

A convenient payment option, pay over time affords customers increased flexibility to purchase the model of their dreams or to add on essentials like a slip-free plunge basin for a safer, cleaner experience or a maintenance package to protect their investment.

The flexibility of pay over time and the opportunity to choose repayment terms that fit a customer’s budget can allow them to comfortably check out with a higher order value than they may have initially considered.

Plunge offers their customer base Bread Pay installment loans ranging from 12 to 36 months with 12-, 24- and 36-month 0% APR terms for eligible customers.

Since launching with Plunge in October of 2023, Bread Pay has financially empowered Plunge customers to use their buying power to its full potential.

Partnering with Bread Pay® has been a game-changer for us. Their approach aligns perfectly with our goals, focusing on what’s best for our customers and us. This partnership has boosted our sales and, more importantly, helped us make a meaningful impact on our customers’ lives.”

Jason Marrone - Head of e-commerce, Plunge

Explore financing options with Bread Financial®

*Cumulative data from this A/B testing analysis is based on the merchant’s loan activity dated March 19-31, 2024. Results may vary by merchant and not all merchants will achieve these results.

**Cumulative data from this case study is based on the merchant’s loan activity dated October 2023 through May 2024. Results may vary by merchant and not all merchants will achieve these results.

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

To learn more about Bread Financial, our global associates and our sustainability commitments, visit breadfinancial.com or follow us on Instagram and LinkedIn.