State of the Economy

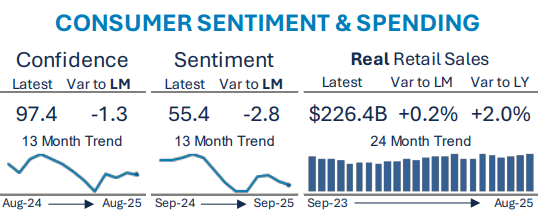

Sentiment, confidence remain low; spending robust with category rotation

- Consumer confidence and sentiment are both trending flat to down.

- The trend continues to be one of consumers expecting “another shoe to drop.” While current condition sentiment isn’t great, it’s much stronger than expectations around future conditions.

- Most major tariff initiatives are now in place, notably the elimination of tariff exemptions for de minimis packages. Trade deals are progressing with some key ones still outstanding and more news to come on furnishings, semi-conductors and pharma tariffs.

- August spending seemed to reinforce some of the tariff concerns with strong spending in apparel, non-store retailers and Sporting Goods/Hobbies.

- While year-over-year growth is still robust, meaning strong growth across many of the Retail Sales categories, the monthly trends seem to offer insight into the evolving consumer needs with Non-Store, Apparel and Sporting Goods/Hobbies as the key winners in August.

- Non-Store grew 2.0% month over month, compared to 0.8% the prior month (which included Prime Day). Clothing grew 1.0% month over month and Sporting/Hobbies +0.8%.

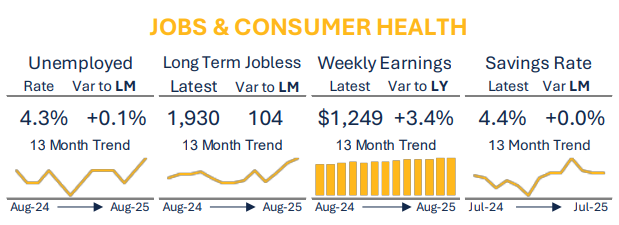

Employment picture showing cracks; wages, savings rate stable

- The unemployment rate did break out in a negative trend from its previously narrow 4.0-4.2% range. At 4.3%, it remains a generally healthy rate but certainly trending in the wrong direction.

- Equally concerning is the lack of job growth. Restatements through March 2025 removed ~900K jobs, and revisions to recent months combined with a soft August jobs report have heightened the concerns that job growth is stalling.

- Long-term jobless (27+ weeks) increased again, to over 1.9 million. Weekly claims have remained generally stable, at around ~240K. This suggests a continued disconnect between the skills employers' need and the skills for those who are struggling to find work. Given the current economic uncertainty, employers remain in a “retain and maintain” approach to their workforce, which may be further exacerbating the issue of long-term unemployment.

- Wage growth in terms of weekly earnings was stable at 3.4%, still higher than inflation by 50 basis points with both wages and inflation increasing. That narrowing gap bears watching.

- This is sufficient for consumers to maintain their financial balance sheet. With tariff revenue rising, the risk continues to be that as inflation increases in the coming months, consumers may find themselves back under similar pressure as seen in 2021-23.

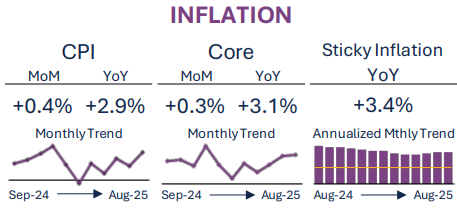

CPI increasing; core, sticky inflation above 3%

- Overall CPI increased again by 0.2% to 2.9%; tariff impacts are continuing to translate into higher prices over time.

- While tariffs played a role in the higher inflation, there were also strong increases in key services, including airfares, physician services and auto repair/maintenance.

- While used car prices did increase (+0.4% to LM, +6.0% to LY), by comparison new vehicle prices remain subdued (+0.1% to LM, +0.7% to LY) as auto makers remain willing to absorb the tariffs for now.

- There were bright spots; gasoline remains low, electricity saw a nice monthly decline and medical care commodities did as well.

- We do expect prices will increase further in the coming months. The slower impact of tariffs remains a confluence of inventory building ahead of tariffs taking effect, retailer reluctance to raise prices and a willingness (for now) to absorb some or all the price impact.

Disclaimer

This summary is provided for informational purposes only and does not give and should not be construed as giving business, investment, legal, tax or other advice. This presentation has been prepared without taking into account the financial or business objectives, situation or particular needs of any particular person. Without limiting the generality of the foregoing, Bread Financial is making no projections or statements about (1) the future financial performance of any company or Bread Financial, (2) the development of any company’s or Bread Financial’s business, or (3) how any of the information may affect any company’s or Bread Financial’s business. The information is presented for the recipient to evaluate, and Bread Financial disclaims any responsibility for any reliance on the information – all recipients of the information should independently review and research the information presented, evaluate their own information and information from other sources, and reach their own independent conclusions. Actual events and outcomes could differ materially from those anticipated in this presentation. This presentation constitutes confidential information and is provided to you on the condition that you agree to hold it in confidence and not copy, reproduce, disclose or distribute it in whole or in part without the prior written consent of Bread Financial.

Definitions & Sources

- CPI is sourced from the Bureau of Labor Statistics with additional insight on Sticky Inflation coming from the St. Louis Fed – FRED (Federal Reserve Economic Data) based on their public releases.

- The orange line for Sticky Inflation represents the target rate that the Fed has publicly stated.

- Consumer Sentiment is sourced from the monthly University of Michigan survey and due to timing of release tends to run ahead of Consumer Confidence which is sourced from The Conference Board monthly survey.

- Real Retail Sales comes from FRED with inflation indexed to 1982-1984.

- Unemployment data on both the unemployment rate and the number of persons dealing with long term unemployment (27+ weeks) are both sourced from FRED.

- Weekly wage data is the nominal (not inflation adjusted) weekly wages reported by FRED from the Bureau of Labor Statistic monthly release and is a combination of weekly work hours and hourly wages and is only private industry data (does not include government wages)

- Savings Rate data is also sourced from FRED and is sourced from the US Bureau of Economic Analysis based on their Personal Income and Outlays release.

- All commentary is proprietary to Bread Financial and reflects Bread’s assessment or summation of publicly available data, commentary, and resources combined with Bread’s perspective based on this data and other proprietary data sources

About Bread Financial®

Bread Financial® (NYSE: BFH) is a tech-forward financial services company that provides simple, personalized payment, lending and saving solutions to millions of U.S. consumers. Our payment solutions, including Bread Financial general purpose credit cards and savings products, empower our customers and their passions for a better life. Additionally, we deliver growth for some of the most recognized brands in travel & entertainment, health & beauty, jewelry and specialty apparel through our private label and co-brand credit cards and pay-over-time products providing choice and value to our shared customers.

Bread Financial proudly marks 30 years of success in 2026. To learn more about our global associates, our performance and our sustainability progress, visit breadfinancial.com or follow us on Instagram and LinkedIn.